|

|

Motor car road traffic accident damage recovery, is what our subject is all about.

|

Below please find some issues and occurrences of common interest, listed and linked.

Car accident issues that matters most:

|

|

|

facilitating a claim

facilitating a claim

claim against the liable party causing the car accident enforcing full and fair compensation . . .

|

|

Should you do not find the issue you are looking for, contact RAMLA (Road Accident Management & Legal Action), as one of the most experienced experts in matters of car accident damage recovery claims.

We however believe the issue in question will be found on one of the other pages on the

RAMLA comprehensive MVA - motor vehicle accident - Information Platform,

but as we haven't installed a search function, rather contact RAMLA, instead of waste time for a search.

There are sections in the main top selector, such as claim, assessment, legal and insurance matters; you may navigate to find what you're looking for.

Car accident damages as result of a traffic collision, always gives task and commonly hassles, unless one do have a compressive motor insurance cover that lives up to the promises made.

But unfortunately, that's not always the matter and if ordinary South African motorists are asked, if they believe and trust a valid claim is a guaranteed matter, one will hear a number, if not the majority of those questioned, doubting that it will be so.

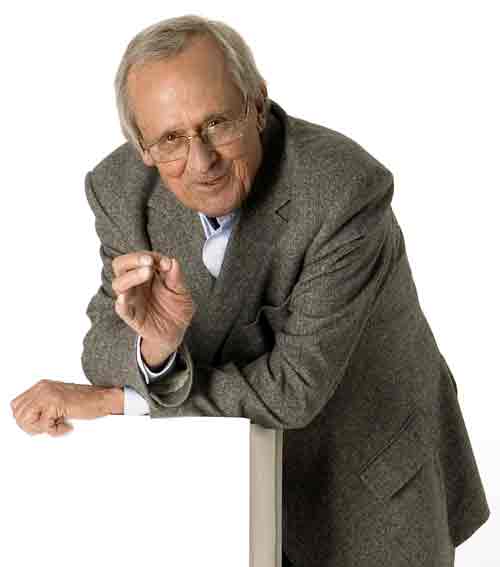

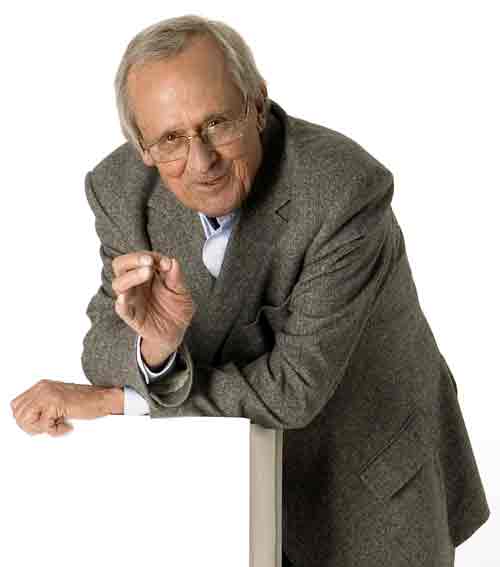

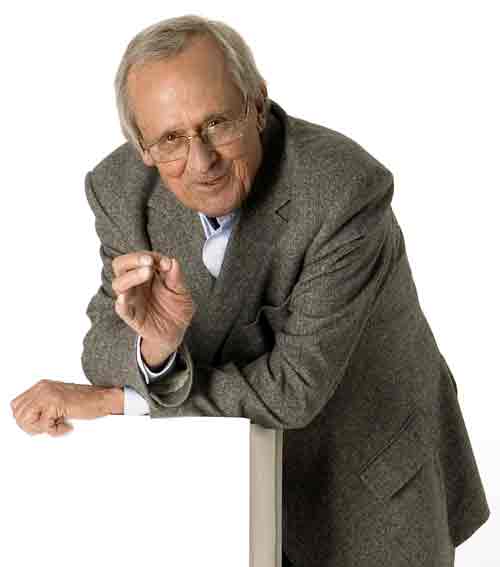

Your specialised expert to sort out MVA matters Your specialised expert to sort out MVA matters

Professional - competent - swift - decisive and affordable

|

|

|

Issues with South African Motor Insurance companies

|

|

Should a matter be taken to a court of law?

Most commonly the overwhelming number of disputes or claims can be solved in pre-litigation, but if no amicable solution can be found, matters sometimes need the escalation to a court of law to be solved.

It should be noted, that most of the deciders of claims, (insurance claim admins, claim evaluators or technicians, however called and other representatives, regularly do have no certified legal competences.

This means the decisions made to either accept or deny a claim are performed by persons with experience, but often not applying a legal background, taking all facts in consideration, but all too often rely on party statements, without a check on the balance of probabilities if that point of view may represent the correct situation, or act biased as to benefit schemes or other incentives, declining claims to cut down on compensation pay-outs.

Approaching a court of law give the certainty to have the case evaluated to the laws prevailing in accordance with the particular applicable situation, and after analysing the parties written arguments exchanged in the pleading phase of the trial, hearing the plaintiff and the defendant, as well as witnesses and thereafter the judicial officer will come to a decision, making it an order of court.

It is obviously clear, that such comprehensive analytic process will be by far better, than just accept an unjust decision of a person in charge, neglecting the basics of fairness to look onto a claim unbiased.

It may therefore be fairly well to accept the initial costs, coming with a legal action in a court of law, but given the evidence is supportive enough to convince the court on the basis of probabilities to decide in favour of the party, to get compensation and a refund of costs necessary to pursue the claim in court.

|

|

|

|

The RAMLA web pages are designed to supply you with valuable information's to sort out material motor car accident compensation cases occurred in a traffic collision on South African roads.

You will find a lot information that can help you to claim for damages or to deal with disputed motor insurance claims and even to defend you, if you face an inflated high and unreasonable claim against you.

|

|

|

On your way looking for a professional car accident damage assessment, to quantify and calculate your traffic accident damages occurred one of the provinces of South Africa,

Gauteng - Freestate - Northern Cape - Limpopo - North West - Mpumalanga - KwaZuluNatal (KZN) - Eastern Cape - Western Cape -

you found the RAMLA web pages giving you some ideas about the pro and cons of an independent damage investigation and what you should look on to get a reliable accident damage report, helping you to proof the material claim, against the liable party or the motor insurance company.

Even if you are located in one of the mayor cities of the country such as Cape Town - Bloemfontein - Johannesburg - Soweto - Pretoria - Polokwane - Durban - East London - Port Elizabeth - or in the wider areas around those cities or wherever in the county you are,

RAMLA (Road Accident Management & Legal Action) can support you with various service options nationwide.

Working with RAMLA will of course be the most comfortable and economic support in pursuit of a legal compensation claim, whether against a 3rd party or directed to any motor insurance company in South Africa.

Motor car accidents happen on a daily basis, and in all the South African provinces, wherever you are, in Gauteng - Freestate - Northern Cape - Limpopo - North West - Mpumalanga - KwaZuluNatal (KZN) - Eastern Cape or in the Western Cape.

In the several provinces you find differences in the level of risks, according to traffic density, conditions of the roads, day and night times, weather conditions and many more.

A motor car accident rarely does happen just out of one singular fault. Mostly more influential factors and other negligent actions must get together causing a traffic accident at all,

when driving through Cape Town or Kahilitsha, Paarl, Parow, Calvinia, Springbok, Vredenburg, as Port Elizabeth, but not just there.

In all our South African cities and even in rural areas, are risks by travelling a vehicle on public roads. Be aware that most accidents happen in your very near neighbourhood or on your daily way to or from work in your home town Middelburg, Graff-Reinet, Somerset - East or Somerset West, Grahamstown, Bisho, Zwelisha or East London, due to the facts that one who is very familiar with this routine, will not be on the alert level one should be.

You can minimise to be dragged into an auto collision, if you concentrate on the traffic, abide by the basic precautions and don't contribute negligent in driving, by let's say texting or telephoning behind the steering wheel.

But even if you live in other small towns or mayor cities such as Umlazi, Durban, Pietermaritzburg, Potchefstroom, Port Elizabeth, Knysna, Krugersdorp, Oudtshorn, Mossel Bay or Worcester you have to be aware of the danger by making your trip.

Other road users may not be up to their best abilities, be drunk for example or driving a motor car that better should not be on the road, as it is not roadworthy and so poses risks to other motorists.

Just participate in local traffic within the towns and villages as Roberson, George, Kimberly, Rustenburg or Mabopane, you can be caught up in a vehicle crash at all times, despite you may drive carefully and respect the rules of the road. The other party is always even your risk.

Minimising the probability to be caught up in a road crash, especially in bustling cities such as Pretoria, Johannesburg, Soweto, Germiston, Rustenberg, Welkom, Bloemfontein, Polokwane , Durban or Cape Town, where high volumes of motorist getting along all day, the risk to be involved in a car accident is much higher than just travelling in quieter areas as Klerksdorp or Mahikeng.

The best will be, if you are on high alert all the time you drive a motor car. Taking care of keeping proper following distances which is a very good measure not to be involved in car accidents,

when you on the roads of Kimberly, Queenstown, Beaufort West, Prieska, Upington, Vryburg, De Aar, Belfast, Bethlehem, Kroonstad , Harrysmith, Mabane, Nelspruit or Ermelo.

In huge metropolis as Johannesburg or Cape Town where you deal with rush hours when commuters get to and from work in the morning and evening hours, the danger to be trapped up in a motor car accident are explicitly higher as to other traffic times.

If you have been unlucky dragged into an auto accident caused by another one or more motorist who drove negligent, not abiding the rules of the road or even careless and subsequent suffered material damages to your motor car, you want that the liable party pay compensation you for losses.

|

|

|

|

Important Information:

RAMLA don't do any physical damage assessments itself.

We do make use of external experts, in cases we handle the compensation action, where a need is detected.

RAMLA cannot help someone in need for MVA damage assessment.

You may however get a first free evaluation of your damages from us, but just drawn from pictures you may send through to us by email, especially if you are concerned to have to deal with "write off" the car.

We may further be able and advising you where and how to get your damage assessment - nationwide - , depending on where the car is located.

RAMLA is a professional specialised expert in all matters of MVA compensation actions, defence against unreasonable or inflated claims, engage in disputes with parties or Motor Insurance companies, or guide a matter for review to the Ombudsman, up to get the matter proceeded in a court of law, if no amicable settlement can be achieved in pre-litigation.

We don't offer any Assessment Training.

If it comes to claim for the recovery of damages suffered in a crash on South African roads, the value of the destruction in money needs to be evaluated. The damage value is always a matter that is supposed to cause a dispute with any other party involved in the motor crash and held liable to pay for a professional repair of the motor vehicle.

There is the way for a victim to choose the local panel beater as the source to estimate your damages. This is the most popular method in South Africa, but not always the best and stable proof for damages to claim. The other party can always dispute your equation listing the damages.

More often the damage or repair value comes to a discussion, if a motor insurance company is involved when a claim had been reported to them to pay for the other motor car damages.

From a certain value the car insurance don't trust or accept the other parties damage listing immediately and most commonly send an own car accident assessor to see the damages and draw a damage report for them.

One should know that the results of such damage report will most frequently being the basis of any settlement offer, but you can still expect other factors that are applied to drop down any compensation offer.

A damage evaluation of an assessor send by the motor insurance and recruiting work out of the insurances business can be expected to be or have a tendency as party friendly in favour of those who pay.

A lot of factors contained in the damage report, can thereby have effect on the oncoming claim procedure, such as the damage value at all, the ratio of market value and damage the estimation of the market value, quite often a hurdle to get over with the insurance company, and much more.

The most important challenges of a good and professional vehicle damage assessment are, (next to your car details and sufficient photographs):

The correct listing of damaged parts as well as the repair value, the fair and unbiased determination of the market value of the motor car before impact and the Scrap value or salvage if applicable.

If the results of a vehicle assessment say the car is a "write off", or total loss, be on alert as it can easily work out detrimental to your compensation.

Please follow the links to have more detail information. RAMLA welcomes your comments or critics of positive or negative.

Check out the RAMLA web pages about the facts or even better make use of the free first evaluation, RAMLA offers you, briefing the claim manager with your matter by email, absolutely free of charge.

Independent vehicle damage assessment is the more accurate and reliable method of listing your motor car accident damage than those of a damage repair quotation. A professional vehicle damage assessment is done by a qualified assessor with extensive training and equipped with the latest IT technology and software to draw a damage assessment report that reflect all you need to know.

There are notes about the vehicle details examined, its technical general and detailed condition, details about important values as market value and salvage and sure the amount of money to be spend to repair the motor vehicle.

This and more will often be the basis to decide for motor insurance companies if they authorize the repair or if they consider the vehicle as written off, which should ring alarm bells with the victim of the damaged car.

You found the RAMLA web page because you were looking for some general information on how to proceed in a case of a car accident in South Africa. You will find lots of information about it here to support your own claim pursues or even to answer questions you might have in your car accident claim.

If you want support to be compensated for your car accident damage RAMLA can be your one stop solution.

You are looking for support to sort out your motor car accident damages in occured one of the provinces of South Africa

Motor car accidents happens every day all over the country, whether in the South African Provinces, Gauteng - Freestate - Northern Cape - Limpopo - North West - Mpumalanga - KwaZuluNatal (KZN) - Eastern Cape - Western Cape - or in any town or village on high ways or other roads.

then you are on the right web pages.

Located in one of South Africa's mayor cities of the country such as Cape Town - Bloemfontein - Johannesburg - Soweto - Pretoria - Polokwane - Durban - East London - Port Elizabeth - or in the wider areas around those cities you are exposed to a higher risk being involved in a traffic accident, due to more dense traffic, as if you live elsewhere in the county.

RAMLA (Road Accident Management & Legal Action) can support you with various service options nationwide, if you unlucky be caught up in a road accident and have to look for compensation to recover your damages.

Working with RAMLA will of course be the most comfortable and economic support in pursuit of a legal compensation claim, whether against another party or directed to any motor insurance company in South Africa.

A motor car accident rarely does happen just out of one singular fault. Mostly more influential factors and other negligent actions must get together causing a traffic accident at all, driving through Cape Town or Kahilitsha, Paarl, Parow, Calvinia, Springbok, Vredenburg, or Port Elizabeth, but not just there.

In all our South African cities and even in rural areas, are risks by travelling a vehicle on public roads. Be aware that most accidents happen in your very near neighbourhood or on your daily way to or from work in your home town Middelburg, Graff-Reinet, Somerset - East or Somerset West, Grahamstown, Bisho, Zwelisha or East London, due to the facts that one who is very familiar with this routine, will not be on the alert level one should be.

You can minimise to be dragged into an auto collision, if you concentrate on the traffic, abide by the basic precautions and don't contribute negligent in driving, by let's say texting or telephoning behind the steering wheel.

But even if you live in other small towns or mayor cities such as Umlazi, Durban, Pietermaritzburg, Potchefstroom, Port Elizabeth, Knysna, Krugersdorp, Oudtshorn, Mossel Bay or Worcester you have to be aware of the danger by making your trip.

Other road users may not be up to their best abilities, be drunk for example or driving a motor car that better should not be on the road, as it is not roadworthy and so poses risks to other motorists.

Just participating in local traffic within the towns and villages as Roberson, George, Kimberly, Rustenburg or Mabopane, you can be caught up in a vehicle crash at all times, despite you may drive carefully and respect the rules of the road. The other party is always even your risk.

The best will be, if you are on high alert all the time you drive a motor car. Taking care of keeping proper following distances which is a very good measure not to be involved in car accidents,

when you on the roads of Kimberly, Queenstown, Beaufort West, Prieska, Upington, Vryburg, De Aar, Belfast, Bethlehem, Kroonstad , Harrysmith, Mabane, Nelspruit or Ermelo.

In huge metropolis as Johannesburg or Cape Town where you deal with rush hours when commuters get to and from work in the morning and evening hours, the danger to be trapped up in a motor car accident are explicitly higher as to other traffic times.

If you have been unlucky dragged into an auto accident caused by another one or more motorist who drove negligent, not abiding the rules of the road or even careless and subsequent suffered material damages to your motor car, you want that the liable party pay compensation you for losses.

Lot of problems may arise, if you give your insurance company a reason to decline or reject a claim, despite you paid all up to date trust to be on the safe side if any car accident claim comes your way.

A variety of reasons for an insurance company, most often are based on those terms and conditions you agreed upon, when you are not taking the small and seemingly unimportant things serious and comply to all times.

For example, if you fail to inform your insurance company of the relevant regular driver, there will a high possibility that your claim may be rejected on such argument.

It will be good for you, if you try to have proof of what and when you submit something relevant to your insurance company.

Generally a motor car insurance policy, to be covered for car accident damages, either for 3rd party claims or even insured comprehensive (paying to cover your own auto crash damages according to the tariff chosen), will be a good thing, or even better that all motorist in public traffic have to have at least a 3rd party cover for vehicle accident damages. Ideally this should be obligate for all motorists in South Africa, before driving in public traffic.

As there is a culture of competition by South African motor insurance companies, for the lowest tariffs/premiums to pay haveing the motor vehicle insured, but still offering excellent service when there is a need to claim from such motor car accident insurance cover must not mean you may be inconvenient surprised when you are in the hope to have sorted out all you wanted, not struggling if you once be involved and liable for car accident damages.

For those who are critical enough to see the interdependence between low premiums and generous compensation, it will not be a surprise if the premiums are low and the compensation should be high, will be not the rule as rather the exception.

Before you insure your motor car it must be looked onto the details carefully prior choosing a motor insurance tariff or policy.

Enabling the insurance company to offer low prices for such motor insurance cover, there will probably be the need of different tariffs with altered covers, they may say to you - tailored just for you.

That may lead to exclude things; one believes should be covered under the insurance plan at all, but may be not under the specific insurance policy offered.

But when it comes to a motor vehicle accident claim launched to your insurance company, some insurance companies or its brokers try down scaling the risk covered.

The claim negotiator in charge will look into your insurance plan, in order to find loopholes and subsequent to lower its payments for claim compensation.

Insurance companies more often than not, apply strategies to avoid or minimise such compensation payments and it can be a challenge to have the claim accepted, to the conditions that enables the victim of motor crash damages to repair the vehicle professionally.

Rarely one will be paid out what have been initially claimed for and being suitable to be full and fair compensated for traffic accident damages, without putting high pressure and good arguments on to such insurance brokers or claim administrators that handle the claim on behalf of the insurance company.

Even the Ombudsman for the short term insurance recommends putting pressure onto the insurer, when no amicable settlement can be reached.

Lot of South African insurance companies have in common, not to be very active if a claim is launched. Some manage to be very silent and/or most often have arguments in place to downscale the damages or shift liability to other parties in terms trying to blame the other party to be partial liable, or use other arguments to get around the compensation payment.

All those measures must not necessarily be the right ones, but sometimes suitable to confuse the claimant.

It had even been observed, that South African insurance companies, represented by the claim management, argue against its own terms and conditions and simply apply to positions that are not in line with your individual insurance scheme.

Such things can be the argument to reject a claim.

Other conflicts can arise out of an insurance vehicle damage assessment, i.e. finding the tire profile of one tire too low or apply other terms that might be suitable to dispute the insured car has been roadworthy to the time of the accident.

Disputes about the market value and applicable repair costs are very common, therefor the insurer make your vehicle a "write off" claim. Such "written off" claims must be looked on very carefully and where possible it should be rebutted as such. A claim called a total loss can easily end up to your disadvantage and most often you need support to be able to rebut such classification successful.

One should be aware, that the slogan used by South African motor insurance companies, to pay out "immediately" . . . . . if the claim is approved. This final acceptance is needed, before they pay, when you claim.

You need to go through the full process to arrive at an approval that suits your claim being able to repair the car accident damages professionally and to manufacturer's standards.

This can take time and being sometimes a challenge. Unfortunately that can take weeks or months; eventually you even need to go to court, to sue your own insurance company to pay.

If you are in dispute with your own insurance company, you can relate the dispute to the Ombudsman for short term insurance in South Africa for review.

But don't make a mistake believing this will be quick and without hassle for you. The Ombudsman's office is poorly stuffed according to its own statement and it will take probably some months before a review is finalised.

Motor Vehicle Accident

We offer the solution in Car Accident matters, analysing, supporting, demanding, corresponding, negotiating, settlement agreements and further taking matters to a court of law in South Africa, if no amicable solution could be found, in pre-litigation, to best favourable conditions in a professional and decisive routine.

Facing challenges with motor car accident issues in South Africa?

RAMLA will be the solution,

demanding compensation, resolving disputes, defending against inflated or unreasonable claims,

in all sectors of vehicle accident damage compensation problems.

|

|

|

|

Motor vehicle accidents happens every day on public roads, often causing damages to property

Utilise the affordable professional solutions RAMLA offers clients in South Africa, to solve such repercussions.

We do have the expertise and know how to act for you.

Experience exceptional service, testified by clients, even after hours or weekends, giving you a peace of mind your case is taken care off, no matter what.

|

|

|

Your specialised legal expert to sort out MVA matters Your specialised legal expert to sort out MVA matters

Professional - competent - swift - decisive and affordable

|

|

Accident Management & Legal Action

First stop solution for a MVA problem

|

Professional MVA Damage Assessment - the best way of document and verify car accident damages to proof a Quantum

|

|

|

Damage Assessment - a cornerstone to proof the amount of damages

Calculation of vehicle destruction and its repair costs to compensate for losses caused by car accidents

Professional vehicle damage assessment, calculation of car accident damage repair costs, appraisal of traffic accident destruction, motor car damage repair quotations, all do have the purpose to quantify damages happened to a motor vehicle, damaged in a road accident, as a basis to demand and sue another or a party for payment.

Fair and correct vehicle repair cost calculations are as important as the question of causation and liability. As South African law states, a motorist involved in a car accident, should be compensated for damages to property or vehicle, as to the value and state, the damaged item has been in, before destruction in a traffic collision.

It may imply to a car owner, one can expect getting the motor car professionally repaired so as it had been, before the traffic accident and it is as such, in general.

A maxim under South African law however is, not to enrich someone, in regard to motor vehicle damage, by way of a compensation action. In order to achieve such goal, the maximum compensation to claim for, will be the market value of a motor vehicle, in the state before the impact or pre-collision value.

That implies that once professional repair costs will exceed such market value, the car cannot be economically repaired, as the spending for repair would be higher as the effective value of the vehicle. That is commonly known as "write off" or total loss.

When does the need for a professional expert assessment, calculating car accident damages, arise

The need to do a professional and hopefully independent damage assessment can arise, in privately initiated damage recovery actions - from/between parties, or for evaluation of damages by Motor Insurance Companies, or requested by other experts representing a car accident victim, on behalf of clients.

It must be noticed that a difference exist between a repair quotation and a professional vehicle damage assessment. An assessment must be performed by an experienced expert and be expressed in a written expert report. The quality of the assessment must have the authority to give credible evidence in a court of law.

A party claiming for compensation must be aware, that any damage or destruction calculation is key and the basis for the figures, in every settlement offer.

|

RAMLA is a specialised legal expert in all MVA matters, claims, disputes (3rd party / comprehensive Insurance cover) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

Therefore it is obvious, that the damage calculation is the central basis for any claim Quantum. The party deemed liable causing the impact, or the insurance covering such risk on behalf the liable party, must be provided with the Quantum of the damage.

Should the damage assessing comes in a form as a repair quote/offer, made out by a competent workshop and if submitted more as one of them, only the lowest will be the one taken into account.

It is our advice, not to submit more as one quote initially and even not the lowest. Submitting rather the highest quote will leave some space for deductions, which must always be expected, at least dealing with South African motor insurances.

A privately initiated professional damage assessment won't be necessary for just initially addressing the damage and repair cost calculation.

A professional damage assessment, or even a traffic accident reconstruction expertise, will only be needed in cases of a dispute, about facts or to rebut incorrect allegations or findings.

In a regular case, where a quote has been submitted to an Insurer or party and damages exceed a certain level of financial value, or reveal discrepancies between other evidence at hand, compared to the demanded amount of damage, the demanded party/insurance will rather send an own insurance assessor to do a cross calculation, which thereafter will forming the basis for any settlement offer.

Assessment is not just assessment, there are many factors that can make a difference in the quality of those examinations or motor insurance assessments. Don't accept wrong or biased insurance assessment without a challenge.

A vehicle damage assessment isn't always a reliable source of examination and may fall short in professionalism, knowledge and experience, or even deliberately apply incorrect methods, supply incorrect calculations about true vehicle damage, which even can possibly be biased or lax calculated, resulting in ("considered") shortfall of a settlement offer, resulting the compensation offered is far too less to repair or replace a damaged car.

The damage assessment therefore is crucial to be correct, fair and reasonable as well a good documented, so that in cases of disputes proof of damages aren't a problem.

RAMLA (Road Accident Management & Legal Action) don't do any damage assessments on its own. Our task is enforcing the compensation pay manifested within the damage calculation, or defend clients against unreasonable or inflated claims, solving disputes between parties and/or motor insurance companies, as knowing about the damages is not enough to get paid.

The aspects of liability and causation are as much as important, if not even more, to get any fair pay for compensation. Contact RAMLA for more.

Your specialised legal expert to sort out MVA matters Your specialised legal expert to sort out MVA matters

Professional - competent - swift - decisive and affordable

|

|

|

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

RAMLA can help clients to solve issues emanating from traffic accidents in South Africa, as we are experts in that field

As traffic accident experts and professional claim managers we analyse, support and pursue your material car accident claim, effective and economical, nationwide in South Africa.

Before any claim can be launched or pursuit, the damage must be analysed. Without a proper damage assessment, either by way of a qualified repair quotation or by vehicle assessment, there will be no certainty for any party, what the damage will be about.

The party or the motor insurance company, facing a claim and sued for car accident compensation, wants to know and be certain, that the damages are calculated fair and complete, and that any damages claimed for, being caused in this particular traffic accident.

On the other hand, the party suffered the damage needs certainty that they can repair the damages for the amount claimed.

Motor Car Accident, in South Africa?

You want your car accident damages being paid for and receive your material vehicle accident damage compensation for destructions, suffered in a traffic accident on South African roads?

You are welcome to contact RAMLA to receive free advice after a free accident fact check to determine your position.

Contact RAMLA (Road Accident Management & Legal Action), tell us your Motor Vehicle Accident story, the issues of concern, the problems you detect or face and get a free check and advice how to proceed.

We will check and analyse your individual case and revert to you - most of the time in short circle -.

For best results contact us by email initially, give us an idea of the incident, attach one or two pictues of the damages or relevant situation, the extend or value of the damages suffered - if already assessed -.

In case of an Insurance claim decline, supply us with a copy of the repudidation letter, of give us the reason for the rejection and name the Insurance Company.

Should you like talking to us (phone contact displayed below), do that after the initial email briefing, but keep in mind even we need some time to check about your matter first.

You are welcome to utilise such valuable absolutely free inital advice. *

|

| RAMLA can be the solution in MVA matters

Do you know that RAMLA is a specialised expert in handling and enforcing or defending all kind of MVA (motor vehicle accident) matters, pursuing motor car accident compensation claims, Insurance dispute resolutions, for its clients - effective - professional - decisive and resolute, to best and affordable fees.

|

|

As you probably have recognised on our comprehensive web information platform, we do know what we are taking about.

We do invite anyone in South Africa, facing an MVA (motor vehicle accident) problem, to contact us for a first - free - analyse of your particular matter and get initial advice how to proceed.

As a specialist in traffic accident recovery actions, we act for clients/members in the relevant manner, but based on a paid mandate or membership, if a need of practical support arises.

We do offer a free first advice, to determinate your case and give you a direction how and what may be the way forward, in order to build confidence with a potential client.

As professional specialists, in charge of acting in motor accident damage claims in South Africa, we offer a well performing, decisive and demanding claim pursuit, at affordable fees.

It's so easy contacting us by email.

The effective way will be sending an email containing the nature, damage and problems detected. Once sent through to us, we will study the matter and after analysing the facts, we get back to you by email (most commonly within about 3 hours), with the result and advice,

- free of charge.

If you like to explain your problem to our claim manager on duty, you are welcome to contact us by phone for an initial briefing on cell 076 770 3179 (standard rates apply).

For best results: dont't just call, once you took notice of the opportunity!

First think what you like to get accross, best file it as email and call therafter.

For reasons to convince you not just calling immediately, please follow: how to contact RAMLA successfully.

It will be much more effective; if we do get a briefing of the matter via email, before a telephone call, so we will be prepared answering your questions.

* please note that a practical claim pursuit will not be free of charge and comes with a paid mandate, but at reasonable and affordable fees.

|

|

Car accident compensation claims for damages, may cause some headache,

in South Africa.

RAMLA can be the solution to sort out MVA problems.

Not everything in a compensation action goes smooth and the way wanted, as we are confronted with numerous possible challenges.

RAMLA is a specialised expert in material car accident damage claims,

demanding, enforcing compensation actions, supporting disputes with Motor Insurance Companies or its agents, work in Ombudsman's review cases, or defend a motorist against unreasonable or inflated compensation claims.

Contact RAMLA to analyse your case, and get a free opinion where you stand and what to do next. You can contact RAMLA 7/24 and receive a response soon.

It's so easy, just e mail your story and attach what you got to make the RAMLA claim manager understand your problem.

Just draft a brief report of what had happen and send it (use this mail link) to RAMLA for free analyses and you will receive a reply soon.

Contact us now and let us know how we can help you?

email us your story and details to ramla@ramla.co.za for a free first analyse and advice.

|

|

|

|

RAMLA offers full legal support to solve car accident claim, a comprehensive claim preparation and action to enforce compensation, all the way up to a court case.

|

|

Why you should consider a professional car accident damage assessment, or go for a second, independent calculation?

The calculation of motor car accident damages can come in different forms. One of it, the professional - individual and independent - vehicle damage assessment, which may proof being the most suitable, and should be considered even spending money covering such costs.

The costs of a professional, independent assessment will be very much lower, as taking the risk and the facing differences or shortfall to effectively needed repair costs, and so avoid lack in compensation.

Such need will be even of more importance, if a vehicle being classified as "write off", as there is a good possibility to have inappropriate values applied, or damages simply wrongly calculated in order to come to a write off, a preferred status for many Insurance companies, if it comes to compensation.

There are motor vehicle assessors in the business, who draft assessments, even without inspecting the damage personally or at all, just take some good or bad photographs, and evaluate the damage over a big thumb, but draw a nice, competent and serious looking assessment report.

A bad or unqualified assessment is possible and it is a serious danger, one must be aware off and all attempts should be taken to avoid having such assessor working out an assessment for your damage calculation.

It is a challenge to oppose the Insurer, once relying on the report. One measure avoiding such surprise will be participate or better be present, to the time of the physical examination and insist to be notified of the time and venue, before allowing the assessment been done.

In South Africa we see a high number of compensation actions, qualified as "write off", beyond repair or total loss, whereby the decisions most commonly are based on any such damage assessment, which may not be good and fair, ending up with wrong recommendations.

Classifying a damaged motor car as a write off, meaning the professional repair costs exceed the market value, will mean a decider in charge for the handling of a compensation action, will rely on such findings and recommendations, contained in an assessment report, as the decider isn't an assessment expert and in so far the compensation offer will correspond to the recommendations.

If an assessment utilised for such a decision don't have the quality, being fair and reasonable in all respects of the factors, such as the effective repair cost calculation, the fair market value and an individual calculated or proven salvage (the value in money, the scrap car/vehicle is expected to trade for), it can carry a number of risks, well be leading to a shortfall in compensation.

Back Page Selection

Back Assessment issues Selection

Back Assessment Matters Site Map

Contact RAMLA . . . for your free initial case analyse Now

Know more about the free first case analyses before contacting RAMLA?

Disputing one claiming/alleging must proof relevant factors

In case of a dispute about damages with the motor insurance company or the other party, in South African law the claimant have the onus or must proof that his/her allegations and facts are true, reasonable and correct.

Should the dispute at stake, may be one of classification to be a write off, and based on a professional vehicle damage assessment by the Insurer, the rebuttal and proof must at least be of equal quality and evidence, as the one disputed. A simple statement, even of a qualified repairer will not be weighted as much as the analyses of an assessor.

However, if the repairers statement and quotation show, that the work will be done full and complete, for less as the applicable threshold for a write off, that should be good enough to press through with this a basis for compensation.

If matters need to go to a review instance, such as the Ombudsman or even a court of law, the quality of the evidence is a major factor to improve the merits of a case.

In a review of an insurance decision with the Ombudsman, there will always be an assessment backing the Insurer. If the content of it is in dispute, only an equal of even better qualified expert can file a report to rebut the Insurance assessment, in order to get the content overturned.

A mere repair quote won't stand against an - even bad or unqualified - assessment, as the Ombudsman will take it for correct, in lack of having something better or more qualified.

Should a matter even go to a court of law, the importance to a proof the Quantum, the damages claimed for, is even more important, as if such proof is not to the satisfaction of the court, no order thought for, in favour of the claimant will be made.

In court there is the opportunity to hear witness and expert witness and in such a case the Assessor will know what is expected to proof and to do, while even if an experienced and qualified panel beater or body repairer will be available to testify, they don't have such routine, but furthermore there will be only be a few - if any, indeed going to court and take position to back up the quote with a testimony.

A repair quotation will hardly be seen as equally qualified as a professional vehicle assessment, despite that may just not be true.

An experienced auto mechanic or panel beater, with years of experience in the job, may well analyse as good or better, as a just trained assessor.

One of the problems we see in the status and credibility of the assessor is that in South Africa, there are no definite norms and/or certified quality of knowledge, one need to have to be a "qualified" professional vehicle assessor.

So it is an important factor and utilise a positively known and reputed expert, to disprove a wrong assumptions or failure in assessing the vehicle damage.

The author of a rebutting vehicle damage report will need to find mistakes and faulty assumptions, which in turn may require to be the more qualified person and just having the better knowledge and experience.

Other disputes occurring in more serious cases, where traffic accident reconstructions are needed to show or suggest, the way all unfolded, sometimes assessors take on to perform the task with just a little training. Crosschecking such reconstruction reports, is always advisable, but will depend on the cost and damage ratio, as such real experts, doesn't work cheaply.

|

|

RAMLA will be your one-stop car accident claim service in South Africa

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defended. Contact

|

|

Testimony in court to support the Quantum of the claim

It happens that a compensation matter cannot be sorted out in pre-litigation, and a claim for car accident damage compensation must be heard and proven in a court of law, to finally achieve payment.

It can/will take time to get through a regular compensation action, and even more time to have matters brought trough procedures in court.

A claim in court can only be won, and an adequate order for payment achieved, if the proof of the quantum or damage value can be demonstrated to the satisfaction of the judge.

Should the proof of the damage not be satisfactory performed and the car been sold or scraped already, it will be difficult to show some additional details and further proof of the quantum, which can lead to have the case won, but insufficient compensation granted as to lack of evidence.

However, if the car has already been repaired professionally, the quotation and the corresponding invoice (recommended are even detailed photographs of damage and repair), accompanied by proof of payment, should be good enough to proof the damages.

Should the car been repaired more privately, and there is no proof of the Quantum as set out above, it will come with challenges, and unpredictable compensation. In order avoiding such problems, it is vital to have proper proof.

Relying on the testimony of the person made out a repair quote, will only be a good idea. Generally a qualified mechanic or panel beater/repair person, will not attend the procedings in court and testify in the way an expert witnes is expected to do, in order to be accepted as such by the court.

As to our experience, only a very few panel beaters or repair workshop people will like it and being more involved in the legal part of a car accident claim action, as is absolutely unavoidable. They may even be reluctant to testify at all, which is understandably, as they rather want the repair order and fix the damages, as that is their business and not that of an expert witness in court.

An expert witness (professional vehicle damage assessor) may be needed to support and present the damage calculation in court, but it will only be a possibility, if the damaged car will be still available in the unrepaired state, to their examination prior to the trial.

Back Page Selection

Back Assessment issues Selection

Back Assessment Matters Site Map

Contact RAMLA . . . for your free initial case analyse Now

Know more about the free first case analyses before contacting RAMLA?

|

|

Car accident damage assessment is your cornerstone of success proofing damage

Mandate RAMLA - Road Accident Management & Legal Action - for successful, convenient and decisive claim enforcement to favourable and affordable fees

Please be reminded that RAMLA itself don't perform any physical damage assessments, but may give a first impression of the damage value, by checking on photographs and perhaps can recommend a suitable assessor in the area the car is located, should that be a need in the current state of the matter.

Please be reminded that RAMLA itself don't perform any physical damage assessments, but may give a first impression of the damage value, by checking on photographs and perhaps can recommend a suitable assessor in the area the car is located, should that be a need in the current state of the matter.

|

|

Professional Motor Car accident damage assessment is your cornerstone of success . . .

A professional motor car damage assessment does serve several important issues and without having a proper analyse, a compensation action may fail, or otherwise be won more easily.

Purpose of the vehicle damage assessment:

1. -

Calculate accurately and verifiable, to factory repair requirements, damage repair costs

2. -

Present the individual market value of the damaged motor car, to date and state before the motor accident.

3. -

Definite the value of a scrap or salvage, if the assessment must recommend writing off the damage.

4. -

Present proof and facts in a report, which shows the damages, photographs and/or other suitable issues, such as the calculation of repair costs in detail.

5. -

Support a disputed matter of motor car damage recovery as expert witness

As a victim of motor car accident and suffered damage to the motor vehicle, compensation must be enforced and therefore the value of repair parts or labour is needed to verify total the repair costs. Such must be correctly proven and arriving at the fair and reasonable quantum of damages.

Only correct assessed and calculated damages ensures, one will be compensated for the accident damage, in a full and fair manner, so being back in the state, the motor car had been in, before the traffic accident damage occurred.

Withstanding declines or standing through in disputes against doubts, the other party may raise, the car accident damage claim must be based on correct, fair and reasonable but complete damage calculation and documentation.

The car accident victim will only be successful in claiming damages and being eventually financially compensated to repair the accident destruction, if the compensation claimed for, will be sufficient documented and enforced decisively.

Proper accident damage documentation and proof alone won't make the other party pay. Professional enforcement, such a RAMLA offers, is needed as the second part of a successful claim.

|

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

It should be in anyone's interest, resolving the unpleasant results of a motor car accident, quick and fair, but in reality disputes must often be expected. Any disputed claim will be supposed to be lost, if the evidence presentable isn't credible.

Avoiding that a claim for car accident damage compensation is based on a wrong value, the quality of the car accident damage assessment is of outmost importance. A claim for car accident compensation in a court of law, might be lost, or partly lost, due to incorrect claim documentation or values, and shouldn't be risked at all.

Car accident damage, assessed by a professional damage assessment or based on a qualified quotation, made out by a qualified panel beater or car accident damage repair workshop, should not be rebuttable in a dispute, if and when claiming for motor car accident damage compensation.

Any claim, successfully defended in a court case, will cost the claiming party a good extra portion of legal expenses, which probably could have been avoided, if a proper assessment had been done in time, most commonly for a lot less than the risks of costs of a suit.

Cost occurring throughout the need to proof the damage, can be included as consequential damages in the claim, and been recuperated/repaid, if the matter has been finalised successfully.

The money spend will be worthwhile, even if matters don't need to be taken to a court of law, getting a claimant in a much better position, as relying on ordinary repair quotations, sometimes made in a quick move.

Don't be fooled by a party or an Insurer, if you are asked to present three different repair quotations. Present just one, but a reliable one in whatever form at the end, avoiding to be pressed down in a settlement to the lowest quotation presented, as the lowest may not be as complete and fair as it is expected and needed to repair the damages professionally and in full.

RAMLA as specialist experts, in pursuing of motor car accident damage claims, for compensation/recovery of material/financial damages in South Africa, strongly recommends not trying to make a fortune out of any car accident damage, don't take chances and inflate a claim, or add older damages to be fixed, into the current action.

That can backfire easily, resulting in a time delaying dispute, or legal cost to award to the other party and will extend times and efforts to get a compensation action processed, as soon as the other party suspects any unfair treatment.

Back Page Selection

Back Assessment issues Selection

Back Assessment Matters Site Map

Contact RAMLA . . . for your free initial case analyse Now

Know more about the free first case analyses before contacting RAMLA?

|

|

Avoid unqualified quotations, not to put your car accident claim on risk!

Mandate RAMLA - Road Accident Management & Legal Action - for successful, convenient and decisive claim enforcement to favourable and affordable fees

Please be reminded that RAMLA itself don't perform any physical damage assessments, but may give a first impression of the damage value, by checking on photographs and can perhaps recommend an assessor in the area the car is located.

You may contact RAMLA in that regard - free of charge.

|

|

Avoid unqualified quotations for the documentation of repair cost and vehicle damages as the burden of proof is with the claimant.

Getting a common motor vehicle repair quotation, is the first choice of many in need to document motor accident damages. It's expected being made out free of charge and good enough to have a comprehensive document, proofing losses or destructions, as results of traffic accidents.

That is quiet an unreasonable expectation, isn't it? Getting work time and efforts of a professional car repairer for free?

Often a party or a representative of a party, in charge for handling a compensation action, ask or even demand, the other party to document damages in three different quotations, only in order taking the lowest and get on with it in a possible settlement offer.

A motorist in need sorting out a damage claim and been asked for more than one quotation, and is prepared to do so, should not submit any quote to the other party, substantially lower and different than the next higher one or the most expensive, unless being 100% sure, that the lowest quotation is a qualified one, includes all needed to get the motor vehicle repaired.

If submitting a quote to the other party, which is insufficient but the lowest one, that one will certainly be the quote taken as to be the fair and correct one, taken as the basis of a settlement.

If the funding for the repair depends on the compensation action, it should even be looked on the time factor, when it can be expected the damage being repaired.

Any disputed compensation claim does take time, before eventually sorted out, and never will be resolved with magic or overnight.

Price increases in the meantime may not come as a surprise, and should be taken into account. A good quotation will adress that and point out the price increase to be expected and probably when.

It may sound a bit difficult, but will pay out, if taken good care to find the right workshop to do a qualified quotation, even if there will be costs for such work. Those costs will be a good investment and being included in a claim action, being no final financial burden for the claimant once the claim is won and the expenses recuperated.

|

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

Don't accept results of a bad or wrong Vehicle Damage Assessment

Damage assessments are either initialised by the victim of the accident, or even very common by the motor insurance company covering a driver for damages.

We actually do see the lower risk of bad assessing work, in an independent calculation, made out by a local panel beater or damage assessor, in charge for that victim, rather finding it more risky in assessment calculations, made in order and pay of the Insurer.

Assessments are based on visual observation of damages. In order to have the correct and near vision, the vehicle to be inspected needs to be accessible. A vehicle stored in a crowded tow yard trapped in between other cars or walls etc., cannot be assessed for damages correctly.

Depending on damages, even parts need to be stripped, to look underneath into the body of the vehicle, in order to see the range of the damage. That will hardly be done on a tow yard, where no suitable workshop or tools may be available, or if, probably only reluctantly available.

The Assessor regularly doesn't take tools in his/her own hands to dismantle parts to find damages. A mechanic is needed to do that for the assessor and such must be available to do so.

Only if all that will be taken seriously and abided to, an assessment can be successful and good and plain the ground to state the damages correctly, in a later report.

As said above, there are many factors influencing the assessment and verifying if the assessment is correct or acceptable, can be even be done by a layman - and that are the most of the motorists - simply by comparing the end result with an previously done repair quotation.

Should the comparison show both end results somehow in an acceptable correlation, both appear to be fair and accurate. Should there however be a wider difference between them, the reason therefore should be analysed. Only thereafter it can be decided which one is the more accurate and acceptable one.

That means factually, one should not rely just on an assessment, made in the order of the Insurer, in trust of them taking care of the claim, but rather do have a good quotation or quality assessment done, before giving permission to the Insurers Assessor to do his work, so a comparison can be done as above, once the report is available.

Back Page Selection

Back Assessment issues Selection

Back Assessment Matters Site Map

Contact RAMLA . . . for your free initial case analyse Now

Know more about the free first case analyses before contacting RAMLA?

Important factors in vehicle assessment reports that can lead to disputes

Factors as - market value - repair calculation - salvage - can be determined by utilising the correct or incorrect sources. Taking the wrong sources, can easy lead to disputes and too often, market value and salvage are the factors, wrongly established or estimated.

Repair Value:

The amount of money in total, needed to repair the damages of the particular car accident, to manufacturer's standards, professionally repaired in full and complete.

That means, calculated time for the jobs and parts needed, ensuring a professional repair, all according to factory standards and factory endorsed repair costs, for specified jobs, with all extra costs, if applicable.

In order to have correct repair values, when it comes to claim for damages, the calculation of destruction must be correct and not only found out later in the actual repair process, that there are more damages, previously hidden by other parts.

It is obviously crucial and addressing the repair costs correctly, right in the first place, to have the funds for the complete repairs and not have concluded a settlement, with no return to further claims, but left stranded with additional costs.

Market Value:

Market value is - the true value - the market supplies for an item being sold to a specific time in a specific condition.

The term market value comes into play, once the damaged motor vehicle is as badly damaged; that the repair costs needed to build up the car again to roadworthiness and condition the car has been in - before the accident, exceed the current value such a car is sold any bought in the free market of used vehicles.

The South African law takes about - pre collision value, when defining the maximum damage or the amount a victim is entitled to claim for compensation.

The definition isn't implying to correspond with market value, but due to precedents and common understanding, as well as the maxim in law, that a traffic accident victim is entitled to full compensation, but not entitled to enrichment, the value the market will pay for the - theoretically not damaged car before impact - is the benchmark for maximum compensation.

The definition of market value can be taken as:

What a willing buyer and seller will accept to strike a deal.

The definition of market value applied by Insurers

Unfortunately the "market value" is sometimes interpreted or drawn from inappropriate value schemes, such as Auto Dealer Value Schemes, carvalue.co.za, bookvalue.co.za or autotrader.co.za.

Those value schemes are consulted and applied, most commonly by the majority of professionals in the MVA compensation field, especially motor insurance companies.

Despite such schemes are actually designed to support motor car dealers, in finding value lines, for buy in and selling values of used motor cars, they are utilised - in our view, inappropriately - for the determination of market value of motor cars in compensation actions.

|

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

Those value schemes, are dealing with motor vehicles listed, to determine the current value of such motor car to a specific point of time.

It is commonly known, that automobiles rather lose value instead of gaining value, once new on the road and thereby been used, in terms as age or years and mileage, next to other minor important factors. The individual type and make of the car, the purchase price according to the year of manufacturing and of course the individual equipment of a particular car is taken into consideration.

Every motor vehicle can be identified by the number given by the manufacturer in process of manufacturing. This identification number is called, Vehicle Identification Number or VIN. This number for the particular vehicle can be easiest found in the registration document or the licence papers.

Typing this number into those filters of the value scheme web offers and answering some additional questions as the current year and mileage, will reveal the value, the particular scheme has been assigned for the car.

It should be noted, that not all schemes comes to the same results. They may differ as to factors only they know about, but can make a difference in the later established "market value".

But no vehicle dealer is obliged or even expected to deal according those recommended values and by far don't adhere to selling price listings, if the market (they do know the real market value by its trade experience) allow getting a better price.

The values returned on such inquiry are:

Trade Value - an orientation of the amount of money a used car will be possible worth to buy the car - for a dealer buying used vehicles - in order to trade with the car for resale and cover cost and profit.

Retail Value - an orientation of the amount of money a used car will possibly be sold for to the public, which will cover purchase price, cost, possible repairs/betterments and profit, in other words the price the car is offered for resale and a willing buyer may pay the dealer for the car.

Market Value - derived from those values above the general motor insurer will apply its own additional calculations, by saying - we take the Trade Value and add on the Retail Value and just divide by two, arriving by our so called "Market Value" applicable for compensation purposes.

As South African law limits the compensation for motor car accident compensation, to the value the motor car has been worth in money, after times of usage and depreciation, to the day or time of the accident, referred to as the pre collision value, sometimes addressed as market value, it is the financial basis for a compensation in money, in cases of a "write off" or total loss.

Market value of a motor car, should literally be understood as the price a vehicle in question has been worth selling, before deformation, and a willing buyer and seller will come to a deal. The real market value is what the market reflects, on offer in the market to buy. The definition of market value, in terms of Insurance determination, does have a lot of potential for disputes.

South African law, don't even know the expression "market value". The law refer to: pre-collision value, in dealing with compensation values.

Unfortunately a number, if not all South African Motor Insurers, utilise such schemes not accurately designed for this particular value, in order to get matters processed in a calculable manner, which may lead to shortfalls.

But challenging the way Insurance companies calculate market value, will either not be easy nor sucessful, unless tested in court.

The real market value will reveal, when checking for dealership's offering motor vehicles for sale, private sales advertised in the classified section of regional newspapers, internet sales platforms and other forms of sales platforms, those are the real indicators as to what price (market value) a vehicle will go and sell for, in the real world.

It must be understood, that any vehicle loses value, once been first on the road (except of very few, such as particular valuable cars, collectors' items or vintage cars) and if it comes to compensation for damages to those cars, there is no way of applying the dealers scheme.

South African motor assessors, as well as motor insurance companies, frequently make use of those schemes, by taking the approach and combine trade and retail value, to arrive at an artificial "market value".

That artificial market value is calculated by adding the two values together and divided it by 2 = market value.

It appears to be obvious, that this method of value determination may be easy, but in no way fair and correct. As the schemes all deal at least with Retail Value, the range of the amount a car is recommended to be for sale at dealers businesses, that value, if any of those data schemes will be utilised, the Retail Value, will be the one most fairly applicable value.

The method may be a way to standardise the research for market value, but will at its best, only be an orientation of the value as a guideline, but regularly not a real market value indicator.

A value deserving the name, which will only be real market driven, if allowing researching and determining the individual motor vehicle sales value.

The real life - sales value - should be paid to a motorist, if in need of replacing a "written off" motor car and avoiding shortfall that must be topped up unfairly by contributing own money, if not an "on top payment" of some percentage, to upgrade the compensation be obligate, if a car needs replacement.

But in reality, we in South Africa, are far away from fair car accident compensation as long as such calculations and determinations prevail.

Salvage:

Salvage is the expression for the wracked motor cars value, which should be received in payment, once the scrap of the motor car will be sold.

Salvage, therefor is a part of the compensation value, and worth something, of which the amount of monetary value, is depending on destruction and other particular issues.

The true value can vary from just little, to a substantial amount of money, mostly as to the type of the car, age and mileage, as well as the condition of those parts, not damaged and certainly which parts are still usable.

The question now, of finding a fair salvage value, is similar to that of determining market value, or can even be more complicated, as to the reasons cited above.

As to prevailing assessing practice, the scrap value will regularly not be calculated based on the individual damages and vehicle salvage value, rather be taken as a fictive percentage of the determined market value.

Such value determination (percentage) is one made just over the very big thumb and got little to do with professional assessment. Salvage value percentages varies, without good reason, from some 20% up to 50% of the determined market value.

Remember, even the market value, determined as definite above, is not a fair or individual one, if taken the Insurance Industries calculation, on which the salvage percentage will be applied, notwithstanding the far reaching problem of the applicable percentage.

|

RAMLA can help clients in all MVA matters to solve problems professionally, claims, disputes (3rd party / comprehensive Insurance cover), review of declines with the Ombudsman (OSTI) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

The importance of the Salvage value, won't be as severe, if the liable party or the Insurer for the party, offering a settlement, will always have the obligation to take over the scrap, for own disposal and pay out the full damage as to market or better pre-collision value, to the victim or claimant of the action.

Unfortunately, the way the party - offering a settlement - interpret or apply the option to dispose the salvage itself, or leave the disposal of the scrap to the victim, is unpredictable.

One Insurance company is eager to take any scrap over for disposal, as they may have a contractual relationship with professional scrap dealers, while another Insurer will fight tooth and nail, not to do so and leave the disposal to the victim, but apply a certain, often unrealistic high salvage value, in the settlement offer.

After all the fight to arrive at an acceptable settlement, the issue of salvage often comes as a surprise to the victim, never had given the disposal much of a thought.

In a case the disposal is left to the victim, commonly a private person and no car or scrap dealer, he/she has either little connections into such industries, nor the ability to negotiate favourable conditions, let alone time spent on research, discussions etc., when forced to dispose the wrack.

The claimant or victim of the impact, now offered cash payment for compensation, but directed to dispose the salvage, will face the deduction of the artificial salvage value from the pay-out.

The challenge now will be to practically sell the scrap to just that artificial, often far too high calculated amount. Should that fail, which is highly expectable, the shortfall will be to the detrimental and loss of the compensated victim.

A fair solution will only be, if the victim do have a choice, of voluntarily accept the disposal, or reject and the liable party must dispose the scrap to self-calculated condition, and pay the victim the full compensation without deduction.

The decision of voluntarily accepting the deduction for the salvage and retain the ownership and possession of the wrack, should only be a favourable decision for someone, who explicitly do know why they want to do that.

One reason can be, that the scrap is calculated rather too cheap - yes even that may happen -, or there is an opportunity to rebuild the car, to better conditions as proposed in the professional repair cost offer.

But at all times, if choosing to go that route, one should really know the challenges and risks, of which roadworthiness is one, as it is not without reason a car is classified a write off.

When can a vehicle be written off:

A motor vehicle, in terms of the South African law is a "write off", once the actual cost of repair to the state the car had been before the collision, are exceeding the pre-collision value of that particular vehicle.

In simple words, once the repair costs are higher as the contemporary car value, the car is written off.

However there is a difference about the benchmarks, as to which conditions, if a motor vehicle is as badly damaged, can be "written off", regarding a 3rd party claim or a claim against private Insurance cover.

The difference will be, if the claim is one of delictual liability, or if a party is claiming from a comprehensive private contractual insurance cover.

Both have different rules or conditions, deciding if and when a vehicle can be, or is a write off.

In cases of delictual liability (negligent driving and applicable 3rd party liability) only South African law apply.

Otherwise in regard of an own insurance claim, the terms & conditions of the private Insurance contract can dictate the condition, when an Insurer will be entitled to write off a vehicle, divergent from existing civil law.

Just making it complete, a vehicle can only be written off by law, if the repair cost indeed exceed the fair and reasonable market value.

In terms of the maximum of compensation, the law is saying and that's we interpret it, - compensation to pre collision value - but not more as the costs for a comparable offer to replace the damaged.

A claimant cannot demand repair of the damaged car at all costs, as it would be against the threshold of the law and if done despite, would abstractly and theoretically create a form of enrichment, which isn't permitted, even if the claimant argue, it's just to get the car back to pre-collision state.

In regard to comprehensive motor insurance cover, we are not in the field of delictual liability anymore, but in a civil law contract relationship. A civil law contract can, and in terms of motor insurance cover will, be bound to the policy and the accompanied terms & conditions.

The policy and terms & conditions will govern the relationship between insurance client and Insurer and accordingly decisions can be different as those only bound to the law.

Insurance terms & conditions do have many clauses and conditions, respectively to all relevant factors and risk covered.

In terms about write off conditions, a policy can state (such may well differ from Insurer to Insurer and policy terms), that the Insurer is at liberty to write off the insured vehicle, as soon as damages amount to a threshold of about 70% of the "calculated" market value.

That is much earlier as the law stipulate. There will even little a claimant can do, other than to go on dispute and for review with the Ombudsman, but all will fail, as it is indeed a condition in the contract accepted and therefore binding.

The only way not to be in that trap can be, claiming from the other, deemed liable party, as in such case only the law apply and that will be 100%, meaning repair cost equals market /pre-collision value.

The reason the Insurance tend to write off a vehicle earlier as the law suggest, must be seen in the possibility opened in a write off, to apply figures and values, as pointed out above, to downscale a compensation pay-out.

On the other hand, claims against a 3rd party aren't as comfortable as a claim against own policy, one reason many may have chosen such cover, and the positives and negatives must be weighted against each other, as a claim against the other party, may result in a better pay, but may take more time.

If you want support to be compensated for your car accident damage RAMLA is a specialised expert in motor car accident compensation claims, disputes and recovery.

|

|

|

|

RAMLA - Road Accident Management and Legal Action - is one of South Africa's most experienced and decisive advocates to sort out legal disputes with parties, Insurance companies or act in defence of clients confronted with unreasonable or inflated claims.

Car accident issues that matters most:

We are legal specialist in motor car accident damage recovery matters and offer our services to those suffering damages or in need to defend unreasonable or inflated claims.

Taking on disputes with motor insurance companies, engage in unfair declines or apportionment of damages, take matter on review to the Ombudsman, or even get matters to be judged in a court of law, should all fail to find a solution before the escalation to a court of law is inevitable.

RAMLA can get you through the trouble, for just some affordable fees, commonly just equal or lower then towing/storage cost may be.

We are one of the most experienced, decisive advocates, when it comes to car accident problems - issues of compensation or defence against unreasonable or inflated claims, bad repair practice and much more.

We work only on those motor car accident matters.

Check us out, so you do know if we can uphold we say, free of charge.

Welcome to RAMLA

|

|

|

|

How going forward once there is a claim or dispute or other challenges?

Well, once someone checks a web site as this one RAMLA presents, there will be some sort of a problem.

It may either be that there is no response from the liable party's Insurer or a repudiation, apportioning or any other decline, such as to violation of terms and conditions.

Lot of those issues may not be according to valid law, and just a reaction of someone in charge don't care, not having the necessary skills or just follow a strategy to get rid of valid claims, should not be accepted.

RAMLA as a specialised legal expert can solve such problems, just for a fraction in fees what you may miss out, if you don't have the right support. It should not be the correct way and get a claimant just been brushed away, isn't it?

Just take the time and contact, tell us about the matter and let us take care of it.

|

|

|

|

Defence against unreasonable or inflated claims?

RAMLA can help you most effectively to get a claim dropped or eased.

The results defending someone against whatever claim, if it isn't as clear what the implications are and what evidence the other party/Insurance do have, are very good to stand through, even if a summons may be served.

The party alleges or accuses is forced to proof the claim and not the demanded party.

Many Insurance recovery claims fall short of such reliable evidence and therefore can be repudiated, even if it comes from attorneys or recovery agents.

|

|

|

|

However we do handle every substantial MVA claim,

against whatever party, Insurance, reluctant party or company successfully, given the merits of the issue are clear and stand a challenge.

Should it not be so in the first place, we do all we can to improve such merits to get the matter being a strong case.