|

|

This RAMLA web platform providing much information on almost all interesting issues in connection with MVA - Motor Vehicle Accident - matters. If you do not find you look for, use our keyword search page and look for the related keyword.

Motor car road traffic accident damage recovery, is what our subject is all about.

|

Below please find some issues and occurrences of common interest, listed and linked.

Car accident issues that matters most:

Keywords Section - X Y Z

no entry

|

|

|

|

Caught up in a car accident

in South Africa, may force a party to claim damages from the wrongdoer,

or may lead to the need to defend against inflated or unrealistic claims.

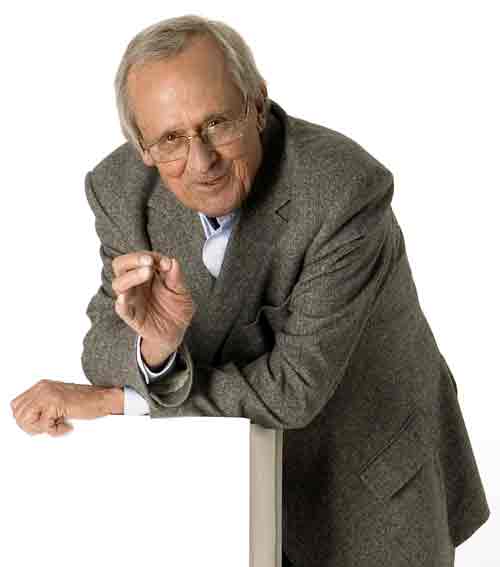

RAMLA - Road Accident Management & Legal Action

Car accident lawyers and professional claim managers, enforcing traffic collision damages, effective, decisive but affordable.

Caught up in a traffic collision were motor cars/vehicles been involved, most of the time material damage or damage to property such as cars or other amenities, will come along with the impact.

An impact causes damages and compensation for repairs is automatically at stake.

RAMLA do concentrate on material or financial damage compensation claims, to get you be paid from the wrongdoer and/or liable party, in an accident scenario.

Such compensation claim can be one directly targeted against a wrongdoer in person, or dealing with representatives such as Lawyers or Motor Insurance Company claim deciders as a 3rd party claim.

Any claim needs to be funded on evidence and factual arguments supported by proof.

Proofing a claim is often easier said as done, as proof comes - in almost all cases - from the circumstances of the accident and evidence need attention right at the scene of impact.

Given if it is missed to secure evidence at the scene and its been not thoroughly attended to, it is time to do it now and act to secure all facts possible.

It is certainly not impossible to get such evidence, even in time after the accident, but it can be more difficult.

|

|

Free case analyse!

Dear valued reader, checking out the RAMLA car accident compensation platform; obviously you do have some traffic accident damage issues to solve.

Contact RAMLA for a free check and advice about your particular case issue. Just tell us about what happened and problem you face.

|

|

It may happen that potential witnesses left without identification, debris be cleared, faulty traffic lights be repaired, or CCTV footage deleted.

Pictures from the scene, document vehicle positions - damages etc., can only be taken, if and when cars still be in its places, which - once available - will have significant value in proofing facts and help reconstruct the impact or scenario.

As much important evidence is in itself, it is evenly relevant to know how to use it.

The ultimate goal is to be compensated for losses.

Experience is needed to be knowledgably and competently in order to address a claim and achieve a fair compensation pay.

Once a claim formulated, documented and served, still the reaction of other parties needs to be waited for and the content thereof to be analysed.

Results will define actions as what steps will or need to be taken next.

As a claim is formulated and supplied, it is to no certainty that reporting a fair claim, even if it is well documented, must lead the other party agree and accept and certainly pay the damages claimed.

Disputes can arise about the way all unfolded, the question of liability can be seen from different points of view, damage value or Quantum be under dispute and many more aspects of disputes can be raised, too much to get to in this column.

Another weak point can be a lack in knowledge how to handle a compensation claim.

People only looking for some advice only a while or even after a longer period of time, past the actual accident, and visit Web Pages such as this one you browse now - often late, and in the meantime doing all they can to address a compensation action to his/her own knowledge.

Many try to act on what may be at hand and they find and regard themselves to be fit for it.

This may work for a number of cases, as matters are clear and facts at hand are strong in its evidential role and the opponent or defendant do not argue unfair.

However it would be too optimistic to believe it is the normality. It is not, as it is almost the opposite, as many cases end up unsatisfactory.

Results or settlement offers may be incorrect in adjustment of liability, often named as contribution to the accident, by not adhere to all the duties, citing perhaps unreasonable precedents and/or allege and apply apportionment.

That may lead to significant losses, shortfalls or complete denial/repudiation of a claim.

Not any layman may be qualified to see through all of that and know if all what one faces in terms of reaction or settlement offers, will be fair and correct.

We do believe it is worth taking time and effort to check out on any doubt, before accepting any proposal.

Sometimes bodily injuries occur in a vehicle collision inflicting harm and pain to humans.

Even bodily injuries do have in some way a financial component and a victim need to be compensated in order to cope with recovery and subsequent costs etc.

However - we the author of this Web Platform - RAMLA - do not deal with bodily injuries claims.

Many specialised lawyers offer its services to solve matters pertaining a RAF (Road Accident Fund,) - bodily injury compensation claim, but the South African Government recommend a victim to first check and find out if one can claim without any specialist, in order not to spend a large portion of compensation on Lawyers fees.

We are specialised expert's in all respects to motor car accident damage compensation

claiming damages, defending against unreasonable or inflated claims, working in Motor Insurance disputes, in all those subjects over a long period of almost 15 years.

We attended thousands of requests, analysing, supporting and pursue material car accident claims, expertly, effective, economical and affordable.

Such excellent service can be to your service Nationwide, in South Africa.

|

|

Free case analyse!

Dear valued reader, checking out the RAMLA car accident compensation platform; obviously you do have some traffic accident damage issues to solve.

Contact RAMLA for a free check and advice about your particular case issue. Just tell us about what happened and problem you face.

|

|

Road Accident Management & Legal Action (RAMLA) can professionally represent clients, taking care of their interests, which can be the solution you may look for.

You will find a lot more of useful information on the RAMLA web pages.

Check out for keyword links in the left column to select your topic.

|

|

Not each and every car accident compensation claim will handled fair, correct and reasonable.

|

|

Initially important is, to know the definition of what we have to understand, is full and fair motor accident damage compensation.

But even before doing so, we have to clarify that the South African System of motor car accident compensation, is split into the sector of bodily injuries, which deals with compensation actions regarding injuries to the human body and material damages, such as compensation for car destruction or consequential damages.

The RAMLA web pages, you are browsing currently, only focus on material damage compensation and civil claim actions to be financial/material losses paid for full and fair, resulting from traffic accidents.

In terms of compensation, the South African law say:

You should materially be compensated to the state before accident, so that you will be able to repair your car to pre-collision status, or if repair cost will exceed such pre-collision or market value; and the car be called a write off, be compensated to the amount of money the car been worth to time of impact, minus any sellable value or Salvage of the vehicle.

That means either you cannot expect a new car (some exemptions excluded here i.e. if your motor vehicle new, not older than a year since being on the road the first time, or depreciation kick in, if your car is fairly used and the marks of wear and tear, impacting your auto value to a specific time.

But even an older motor car must be repaired to manufacturer's standards to maintain the roadworthy status, as long as it will not be a write off.

Motor car accident damage claims may get into difficulties, once another party do not agree with what is claimed for.

Differences may be to condition of Quantum/Repair costs or of Liability.

Disputes must be addressed and corroborated by factual evidence, such as witness statements or pictures, CCTV footage or any other suitable evidence.

A successful claim should be supported by merits, so the other party do not have much to argue, but compelled to accept the claim demand and pay.

A claim launched with your own motor insurance company (comprehensive claim), will have to look on what you have covered under your policy, before any acceptance can be decided upon.

Depending on the cover taken, it can be the insured did accept some contribution, such as excess and the claim process need to be according to terms & conditions of the insurance contract.

A 3rd party claim, directed to the perpetrator however, must give you full compensation and no clauses, as insurance excess or any limitations in a insurance policy apply. Only the law of delict will be applicable to decide liability.

Any claim for car accident damage compensation can go wrong, be disputed or even declined.

As soon as in the process of a claim pursuit any disturbance or unusual investigation requests are noticed, it will be highly advisable to check critically, if your own knowledge and skill is sufficient to perform a vehicle crash compensation action your own, or if you should consider practical support by professionals.

A claim for compensation against another car driver or vehicle owner is a process and cannot be explained in a sentence.

There is a lot about the way to claim and about dispute issues or problems, that can occur in a particular and always individual case, on our comprehensive WEB info platform.

However, as it is often the case, individual problems need individual answers and/or actions.

You are invited to contact RAMLA for a free initial case analyse and advice, by contact us by email ramla@ramla.co.za tell us what happened and the problems you face or expect, for a free reply and advice.

Should you do not like contacting us now, but need more information, check the keyword list to select your issue and find more on the linked page.

|

|

Free case analyse!

Dear valued reader, checking out the RAMLA car accident compensation platform; obviously you do have some traffic accident damage issues to solve.

Contact RAMLA for a free check and advice about your particular case issue. Just tell us about what happened and problem you face.

|

|

|

|

Inflated or unjust claims need proper defence against unreasonable vehicle accident compensation actions

|

|

Defending against inflated claims isn't as challenging as perhaps thought.

Defence against unrealistic, unjustified or inflated claims is a need to do, if alleged to be held liable for car accident damages, which do not fall in your responsibilities.

It is always an inconvenient situation when defensive actions are needed, as to alleged of wrongdoing, which isn't true or fair.

However any person unfairly accused of wrongdoing and causing damages to another in a motor car collision, must enter into defence, not to risk to be sued and end up innocently be judged against one and subsequently face execution, against all of your property.

It should be noted that a claim against a person, is only dangerous, if not defended properly.

Defensive actions mean, deny a claim and its accusation, simple and clear and request proof of facts and merits.

Only if such evidential facts indeed be supplied and its content suest not to allow challenging the accusation, it will be advisable to look for a compromise or settlement agreement.

It must be known, that a person sue another in a Court of Law, must proof that the allegations are true and fair on a balance of probabilities.

Should such a proof cannot be shown, a case is lost and dismissed with costs and the Defendant is released from any liability or compensation payment.

In order to avoid unnecessary risk and hassle, it is highly recommended to utilise professional support to rebut unfair allegations, not to lose out on reasons of lack of knowledge, how to act against such allegations.

|

|

Free case analyse!

Dear valued reader, checking out the RAMLA car accident compensation platform; obviously you do have some traffic accident damage issues to solve.

Contact RAMLA for a free check and advice about your particular case issue. Just tell us about what happened and problem you face.

|

|

|

|

RAMLA is a specialised expert in all MVA matters, claims, disputes (3rd party / comprehensive Insurance cover) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

Motor Vehicle Accident

We offer the solution in Car Accident matters, analysing, supporting, demanding, corresponding, negotiating, settlement agreements and further taking matters to a court of law in South Africa, if no amicable solution could be found, in pre-litigation, to best favourable conditions in a professional and decisive routine.

Facing challenges with motor car accident issues in South Africa?

RAMLA will be the solution,

demanding compensation, resolving disputes, defending against inflated or unreasonable claims,

in all sectors of vehicle accident damage compensation problems.

|

|

|

|

Motor vehicle accidents happens every day on public roads, often causing damages to property

Utilise the affordable professional solutions RAMLA offers clients in South Africa, to solve such repercussions.

Denied or rejected motor insurance claim

|

|

|

Your specialised legal expert to sort out MVA matters

Professional - competent - swift - decisive and affordable

|

|

Road Accident Management & Legal Action

The first stop solution for any MVA problem

|

Motor insurance accident compensation claims, disputes or decline, in regard to comprehensive cover with one of the South African motor insurance companies.

|

|

|

Motor Insurance Policy - rights and obligations, risks and benefits, claim declines based on various reasons, revoke of cover, shortfalling settlement

We are dealing with your rights and obligations, risks and benefits, if it comes to a claim for MVA damage compensation, directed to your own insurance company, launching a claim against your comprehensive motor insurance cover.

Claiming from a South African motor insurance company is not always smooth sailing. The worst case will be a declined or rejected claim, if you need it most.

If you need support, RAMLA can help you to take the matter forward, even in declined motor insurance claim matters.

In the first place, talking about comprehensive motor insurance cover, one need to understand that the main source of guiding the relationship between you, the insured and the company, is the policy and the terms & conditions, of your insurance contract.

In a case of a claim, you the insured hope and trust on the backing and pay-out, for what one believe the risk is covered under the policy. Right here differences may be found, if you don't know exactly what you are covered for and how a claim will be handled, in case of determination for acceptance or rejection of a claim.

Go directly to Headlines page index selection

You will find it easy to deal with your insurance company, if you are classified as a "good risk". This means you will be a client for a certain time already and always paid your premiums to date, but more importantly, you did not claim.

Such good risk, all companies are looking for and in order to keep this type of clients happy, they will probably be generous and quick, if unfortunately one must claim against the policy, once in a while.

But visiting this web page and read the content, dealing with issues or problems, does indicate you don't have the luck of being such "good risk", but looking for a solution solving the differences.

An insured motorist may face difficulties, if in need to claim more often. Such claimant must be aware to be scrutinised more in particular, according the policy terms of the policy and circumstances of the car accident.

This will especially be expectable, if one just concluded the contract and soon thereafter need to claim, or the traffic accident happen at night time, or other suspicious aspects appear.

Another frequent issue having the insurers alarm bells ringing, will be, if the car has been driven by someone else as the so called "regular driver", nominated driver or named in the policy (another than the one listed to drive the vehicle overwhelmingly) and/or if the accident happened in an area far away from the insured risk area, combined with another driver as the regular one.

Those scenarios will almost certain trigger Investigations.

Other minor incidents has been utilised for declining a legitimate claim, such as alleged unlawful leaving the scene of the accident or not obeying the rules and traffic regulation, violation of the Insurance policy or terms & conditions.

It must however be emphasised that a decline of cover can only be uphold successfully, if the insured or the permitted driver has been behaved recklessness. Only just making a mistake, don't be concentrated or properly focussed on driving, which may be classified as driving negligence in public traffic cannot be utilised successful for an insurance claim decline.

But, it can indeed be a challenge to get through to the decider and convince him/her, reversing the wrong decision. The "might" of the Insurance apparatus and the experience of handling, declining claims, are to the Insurers advantage, by far.

Once in a conflict with your own insurance company, strange circumstances can develop. Based on a number of factors, such as breach of the terms (which can entail a variety of arguments), or findings by the assessor or investigator, in pursuing the work to analyse the case circumstances, probabilities and the damage, can lead to a conflict, which needed to be sorted out, by supplying proper facts, rebutting any such allegations.

|

|

RAMLA is a specialised legal expert in all MVA matters, claims, disputes (3rd party / comprehensive Insurance cover) and defensive actions against unreasonable or inflated claims, professional - affordable. Contact RAMLA for your support to have a damage claim paid or defenced. Contact

|

|

If not successful, there is commonly the possibility of a dispute resolution department or person, within the Insurers Organisation, that can be approached to review matters.

Should that even fail, the way to the Ombudsman for short term Insurance (OSTI) can be taken. If that even fails, the reasons must be analysed in detail and if found all those declines aren't coherent with other evidence or just applied from not acceptable allegations, the matter can still go to a court of law.

It becomes even more common, that motor insurances don't just analyse the damages by assessment, but engage an investigator to check out backgrounds, witnesses etc. finding some reasons to argue or decline a claim, if some indicators suggest so.

But it must be pointed out that by far not all investigation results are credible and made in a forensic or investigative acceptable manner. Once getting into the details of such investigations, it may be found that they just lack credibility, and should be challenged.

Traffic accidents causing car damages happen every day on our roads, in South Africa. The challenges to get compensation for destruction to a vehicle or motor car are different, as to the circumstances and situation.

A short breakdown of the headlines on this page will be found by just scrolling down a bit. Those information's given are of a general nature and it may not always explain or suggest a perfect solution for a particular matter.

This is why RAMLA - Road Accident Management & Legal Action - offers a first free analyse and response to persons, faced with motor car accident compensation issues.

RAMLA is a specialised Expert in all MVA - Motor Vehicle Accident - matters and our work is focused just on solution to get compensation paid, Insurance disputes solved or taking defensive measures against unrealistic or inflated claims.

We may well be one of the most experienced experts in MVA compensation matters in South Africa. Anyone having a problem within the spectrum is welcome to contact us.

How to contact RAMLA, in what way best to do and what we need knowing to reply

Your specialised expert to sort out MVA matters Your specialised expert to sort out MVA matters

Professional - competent - swift - decisive and affordable

|

|

|

What you should know and better not miss out to do, when dealing with your insurance company and maintaining your policy duties.

|

|

Motor Car Accident, in South Africa?

You want your car accident damages being paid for and receive your material vehicle accident damage compensation for destructions, suffered in a traffic accident on South African roads?

You are welcome to contact RAMLA to receive free advice after a free accident fact check to determine your position.

Contact RAMLA (Road Accident Management & Legal Action), tell us your Motor Vehicle Accident story, the issues of concern, the problems you detect or face and get a free check and advice how to proceed.

We will check and analyse your individual case and revert to you - most of the time in short circle -.

For best results contact us by email initially, give us an idea of the incident, attach one or two pictues of the damages or relevant situation, the extend or value of the damages suffered - if already assessed -.

In case of an Insurance claim decline, supply us with a copy of the repudidation letter, of give us the reason for the rejection and name the Insurance Company.

Should you like talking to us (phone contact displayed below), do that after the initial email briefing, but keep in mind even we need some time to check about your matter first.

You are welcome to utilise such valuable absolutely free inital advice. *

|

| RAMLA can be the solution in MVA matters

Do you know that RAMLA is a specialised expert in handling and enforcing or defending all kind of MVA (motor vehicle accident) matters, pursuing motor car accident compensation claims, Insurance dispute resolutions, for its clients - effective - professional - decisive and resolute, to best and affordable fees.

|

|

As you probably have recognised on our comprehensive web information platform, we do know what we are taking about.

We do invite anyone in South Africa, facing an MVA (motor vehicle accident) problem, to contact us for a first - free - analyse of your particular matter and get initial advice how to proceed.

As a specialist in traffic accident recovery actions, we act for clients/members in the relevant manner, but based on a paid mandate or membership, if a need of practical support arises.

We do offer a free first advice, to determinate your case and give you a direction how and what may be the way forward, in order to build confidence with a potential client.

As professional specialists, in charge of acting in motor accident damage claims in South Africa, we offer a well performing, decisive and demanding claim pursuit, at affordable fees.

It's so easy contacting us by email.

The effective way will be sending an email containing the nature, damage and problems detected. Once sent through to us, we will study the matter and after analysing the facts, we get back to you by email (most commonly within about 3 hours), with the result and advice,

- free of charge.

If you like to explain your problem to our claim manager on duty, you are welcome to contact us by phone for an initial briefing on cell 076 770 3179 (standard rates apply).

For best results: dont't just call, once you took notice of the opportunity!

First think what you like to get accross, best file it as email and call therafter.

For reasons to convince you not just calling immediately, please follow: how to contact RAMLA successfully.

It will be much more effective; if we do get a briefing of the matter via email, before a telephone call, so we will be prepared answering your questions.

|

|

Car accident compensation claims for damages, may cause some headache,

in South Africa.

RAMLA can be the solution to sort out MVA problems.

Not everything in a compensation action goes smooth and the way wanted, as we are confronted with numerous possible challenges.

RAMLA is a specialised expert in material car accident damage claims,

demanding, enforcing compensation actions, supporting disputes with Motor Insurance Companies or its agents, work in Ombudsman's review cases, or defend a motorist against unreasonable or inflated compensation claims.

Contact RAMLA to analyse your case, and get a free opinion where you stand and what to do next. You can contact RAMLA 7/24 and receive a response soon.

It's so easy, just e mail your story and attach what you got to make the RAMLA claim manager understand your problem.

Just draft a brief report of what had happen and send it (use this mail link) to RAMLA for free analyses and you will receive a reply soon.

Contact us now and let us know how we can help you?

email us your story and details to ramla@ramla.co.za for a free first analyse and advice.

|

|

|

|

RAMLA offers full legal support to solve car accident claim, a comprehensive claim preparation and action to enforce compensation, all the way up to a court case.

|

|

more about ......

Car accident claims for material damage, in regard to your comprehensive South African motor insurance cover; what you should do and what you better not miss out to do.

2.1 You are involved in a traffic accident in South Africa and like to make a decision, whether or not to report your motor insurance claim, to your insurance company,

you should understand some things:

in short to say, always report any incident, that can lead to a claim against your insurance cover, immediately, even if you made arrangements with all the parties involved. Any party can change mind!

Motorists who are involved in a vehicle accident often have questions about whether or not they should file a claim with their motor insurance company and when to file the claim. If you have been involved in a motor car accident, you may not want to put in a claim to your insurer, because you suspect that your insurance premiums will go up in future.

You should think twice when you decide not to report or file a claim with your insurance, despite the fear of rates increases, as unexpected consequences coming later, might be detrimental to you.

Just reporting a claim, or inform your insurance company, that a car accident happened, does not mean, you make a claim for a pay-out at the same time. If you decide not to claim for a pay now and let your insurance company know, you're dealing with the claim, without them initially involved, you are safe in a case if matters escalate later as you cannot come to terms with the other party.

Not coming to terms with the other party can trigger a claim against your policy, some time later and if you haven't informed your insurance company of the possibility a claim may or may not come, it is expectable you don't have insurance cover for this particular case.

An insured motorist should understand the terms and condition and act accordingly to all you have accepted, but on the other hand even force the insurer to be awarded all you are covered for, once you need to claim.

When been involved in a motor accident, it's critical to know what your insurance policy requires you to do, because it could make it easier for you to decide whether or not to file a claim. The policy already might require you to report or file a claim at all, regardless if you consider not doing it now.

Most car insurance policies explicit require you to notify your motor insurance company of any "occurrence" or "event," like an accident, that might lead to a claim being made under your motor insurance policy, whenever there is any possibility that you, or someone else could ask for compensation from the insurance company, you have to notify them in time.

Lots of insurance companies require you to notify them in a specific manner, which is stated in the insurance policy or as required by state law, probably by calling a specific telephone number or you may be required to give the insurance company a written notice of the accident, may be even on a particular form. Time limits for giving such notice and the form will be defined in your insurance contract.

You may face problems, if you don't file a claim or give such notice to your insurance company. The worst problem you may find is that the insurance company cancels your policy, because you didn't do what you accepted with the terms and condition. Remember, an insurance policy is a contract, and if you don't do what you have agreed to do, you violate or "breach" the contract, which may allow the insurance company to deny your claim or cancel your policy.

(2) Getting your comprehensive insurance claim started make sure all will be correct reported

Open a claim with your insurance

Just after or even at the scene of the accident, you will or should contact your insurance company, to inform them that you might need to open a claim under your comprehensive cover.

Some motor insurance companies even offering some support you may need, just after the auto accident happened, i.e. a trustworthy and insurance approved towing service. You should just know which way to contact your insurance company or broker, before you drive off, as a car accident can catch you always and certainly unexpectedly.

After you contacted your insurance company, you should get a reference no your claim will be registered under. This reference number will always be helpful, if you or another one on your behalf, need to get in touch with your insurance.

As a general rule, you should not act and agree for services rendered at the place of the accident, without knowing the conditions. This is especially important, if any road assistance or towing will be needed, which may sometimes be offered, quicker as the ambulance will be there.

Be careful, as some of those service providers take chances, trying to overcharge for towing and very often for storage costs. Most motor insurance companies don't pay all of those costs, if they didn't select or approve the provider.

Be especially alerted, if your car is in danger to be classified as "write off" and not movable without assistance. Don't let the vehicle on any towing yard or other place of storage coming with costs, longer as the shortest possible time.

Insurances regularly only cover such costs, if so at all, unless damages are assessed. Should you just let the car unattended, you may face inappropriate high bills and a refusal to release the vehicle, before not all is settled.

As observed too many times, some "storage" facilities charge fees comparable to Airport parking rates, which is absolutely unacceptable. Should you just learned about those detrimental possibilities, act immediately.

What must be attended by or known when reporting the details of the accident for a claim

The content of the details reported for a perusal of a claim can be crucial in the process.

A claim report should be made after having thought through all the details needed to be taken into account and the one reporting the claim, probably initially over the phone (which will be recorded) or in a written statement must know, that those information are tested against the honesty clause in the terms & conditions of the policy.

In a telephonic report, which as mentioned always will be recorded, the person questioning have a trained skill of asking questions, in order to draft the data for further evaluation.

Any sort of inconsistence with issues or circumstances probably found in a later investigation, can easily lead to a claim decline on the basis of dishonesty, even if there has been no awareness or intend to do so by the insured reporting.

Once on record and proven inconsistencies are found or at least attempted to proof being of such nature, will most commonly lead to a repudiation and can even lead to the cancellation of the motor insurance policy.

The reports, either telephonically or written, will even be tested against other types of obligations an insured is obliged to adhere to, such as breaking the rules of the road, not be vigilant enough to protect against loss of property as other factors that may play a role.

If the information supplied isn't congruent and logical in itself, some problems may be in the forecast.

Dealing with the claim in the process of approval

Once you reported your claim to your insurance, in the manner your T & C may require, you want to get your damages settled as fair and quick as possible.

You will be required to supply certain documents, enabling your insurance claim adjuster to have a clear picture of your case.

Most often it consist out of: your own draft accident report, a copy of the police report, your car - registration - document (not the licence) a copy of your driver's licence the damage assessment or quote and most often a sketch showing the causes and movements of the accident.

Certainly all insurance companies can have different requirements, and you need to meet those best you can.

The insurance adjuster will now check the matter and take measures to examine what they deem fit. It can be that they reach out for legal advice, from its departments or external legal advisers.

In cases where the damages will reach a certain amount (depending of the sole discretion of your insurance company) they will order a damage assessment, carried out by one of the assessors/adjustors they work with.

The results of those examinations will have a major impact, on how any settlement offer may look like. So for you, it is important to know what is going on and best be on site during such assessment.

Kindly note that one of the tasks of an insurance assessor is, to downscale damages as good as ever possible and don't expect it as certain you will get an independent and fair calculation.

Most insurance companies only pay for storage cost until the date of the assessment. So if your car will be stored at a place that charges for the parking, make sure you move it or make arrangements with either the storage company or your insurance. Missing out, it can become costly and even cause a fight with the storing company before they release the vehicle, if not paid up what they will charge you.

All together, the process of an insurance claim, will take some time, and you shouldn't expect a settlement just after some days.

(3) Disputes in the process of an insurance claim

3.1. Apportionment of liability and damages leading to

pay partly for other peoples/parties damages

What does it mean - Apportionment of Liability - and what will be the effect to your pay out?

Apportionment will be needed to understand as a part of liability caused by contributable negligence, that will be blamed on more than just one party, causing a traffic accident. In short, more than one party is at fault out of whatever reasons.

But, and this is a warning,  our motor insurance claim adjusters, by far too often and wrong apply apportioning, in order to drop down pay-out. It is therefore important knowing if any such apportioning is fair and applicable, which isn't always easy. our motor insurance claim adjusters, by far too often and wrong apply apportioning, in order to drop down pay-out. It is therefore important knowing if any such apportioning is fair and applicable, which isn't always easy.

In terms of compensation for damages, this apportioning the settlement contribution, will result for the parties found causal for the accident at all to a financial contribution for all the damages add togeher and thereafter apportioned to the percentage of liability alledged.

In a case, just two parties are involved in the road accident; both parties have to pay a certain amount of the combined damages of both participants, to the determined percentage of contribution.

The determination of the percentage however can be viewed from different angles and as most of those decisions are made by insurance claim admins, such must not always reflect the very truth, as commonly they are looked on one sided. Only a determination of a court of law, will look on both sides equally and its decision may be fair and needed acceptance.

As an example for partly liability:

Car A in front of B is intended to make a U turn on a road marked with a red or white solid line (not allowed to cross) between the two directions of the road, with a speed limit of 60 km/h.

In this example the road have two lanes in both directions and both vehicles drove on the right lane in the same direction. The driver of car A, driving in front of B, attempted to turn left and thereby clearly violates the rules of the road. Turning isn't allowed right here, but nevertheless he did it without hitting anyone else and did have observed the opposite traffic before, showing a safe possibility to turn, despite prohibited to do so.

Car B follows A, haven't observed the traffic sufficiently and/or not maintain a proper safety distance, bumped into car A and caused damages to both vehicles, without applying evasive measures avoiding the impact.

Despite the clear failure of A to turn inappropriate, B isn't just allowed to bump into A. In this case B should have taken evasive measurers, such as breaking and come to a still stand before impact or even just swerve to the other lane, which had been free of traffic, bypass the obstacle to the time of impact.

The fact that B didn't avoid the accident, despite there had been possibilities not but bumping into A, makes the driver B the more liable party. The mistake of A to turn where it's not allowed makes driver A even partly liable.

But what needs to be addressed clearly, that B wouldn't be partly liable, have he had made such evasive attempts to the best he could and despite such not been able to avoid the collision, driver B may not at all be partly liable, as following all obligations in traffic legislation, being aware of danger doing the best possible under the circumstances, to avoid a collision.

What may be drawn from that is, that liability and non-liability can be very close to each other and only some, but important differences will distinguish liability or participants.

The determination of the part or percentage of liability is always an individual matter. Motor insurance companies tend to blame the other party, being partly liable easily.

But those decisions can be one sided and not necessarily definite a partly liability correct.

Motor insurance claim admins, do have an arsenal of prepared statements, drawn from legal cases in the past, citing them as to be appropriate in comparison to this particular car accident, stating that those give them the right to blame and determine the extend of liability of a party, in regard to the precedent.

But there is nearly no traffic collision just as another and even the judges/magistrates accepts, that any case will be different and precedent's just serve for the nature and not the circumstances and should the Insurer ignore those fundamentals, such argumentation must be challenged.

Problems resulting out of insurance damage assessments

The calculation or assessment of damages resulting out of a traffic accident is a central matter, next to the question of liability.

As we are focusing dealing with comprehensive motor insurance cover and challenges on the way to settlement here, we do mean the assessment results, a motor car damage assessor, in mandate of the insurance company comes out with.

The aim of an assessment of car accident dmages should be, that the insurance client will be compensated full and fair, to repair or replace the damaged vehicle.

Unfortunately this cannot be seen or taken as guaranteed. Certainly not all calculations made under the supervision of the insurance company must be subject to criticisms. But unfortunately it happens more than just sometimes that there is a need dealing with a bad, wrong or biased damage assessment. Many reasons can be possible for such outcome. There are i.e. bonuses schemes that award those who have a smaller pay-out per claim as others, or someone suspect in any claim fraud against the Insurer, caused by clients or claimants inflating claims to make a fortune. Others try hard to apply terms and conditions to decline claims, often on reasons not even having a connecting relation to the accident at all.

The problems can be:

Wrong calculations as to lack of professionalism and knowledge.

Assessments in favour of a party (in this case the insurance company) detrimental to the insured.

Wrong assumptions on crucial issues or circumstances.

Wrong classification of vehicle damages when called a "write off" or beyond repair and totalled, without proper backing of facts and values.

Other problems can arise out of interviews with the assessor, or assumptions made on influential factors, being said causing the accident, i.e. assumed non roadworthiness of the vehicle, tyres not having the prescribed profile anymore, alleged drunk driving and a lot of more things.

Remember that all those allegations can, but certainly must not be true and if true it must be backed by proof to have a valid impact. Without proof allegations are of little value and should be rebutted and not accepted.

RAMLA as a specialist in motor car accident damage matters, can support someone in need charging just reasonable fees.

(4) Rejected Insurance claims out of various reasons:

Your car insurance company reject a claim based on your comprehensive motor insurance cover on reasons of:

What to do if my own motor insurance company - comprehensive motor insurance cover - disappoints me with the settlement, or completely repudiate my claim, and I do not accept the arguments they come forward with.

If you make use of your comprehensive motor insurance cover, to solve the bitter results of car accident damages, you may even not be the liable party, caused the road accident crash, but you are looking for an amicable solution and settlement. This is why you take motor insurance cover.

Unfortunately there can be a variety of reasons that lead the motor insurance company to reject, deny, or decline your claim. Breach of your terms and conditions are most commonly seen as the main reasons utilised to reject a claim.

We need to repeat, that insured motorists classified as "bad insurance risk" - people needed to claim either early after the conclusion of the contract or need to put in a claim more often than expected, must brace themselves for problems. Just having one claim in a long term period and have paid up your premiums, will give you a more amicable solution.

Obstacles to overcome in a claim denial can be you are accused of:

4.1. Your premiums are not paid up.

Premiums for motor insurance cover must be paid up, to have a valid cover.

If one don't pay the premiums, even within a period of grace, your motor insurance will rightfully not cover or entertain any claim occurred in a period of outstanding payments.

It is up to you to organise any reinstatement of your cover with your insurance, best before you are on the road, if you like relying on cover. Make sure you do know all the conditions to be met, if a reinstatement takes place.

First premiums for a new policy cover, or cover after changing the Insurer, not paid before the car is on the road, may very certainly give some problems to get a claim attended or paid, if the premium isn't paid, but the nightmare happened.

Everybody should be cautious and sceptical if there is an announcement, you are covered now - and you haven't paid. One better only drive off the show floor, if there is evidence that a cover is in place, even without at least the first instalment paid.

Such similar risks can easily occur when an Insurer will be changed. To be particularly conscientious of that risk, will be the best protection and rather pay first and drive thereafter.

However if such scenario happens, that there is ascertained that cover is given, but the first pay not in the Insurers account, there are possibilities to force compensation pay-out, but will depend on particular and individual circumstances.

If there are challenges over a longer period of time, paying the insurance premiums in time, it may be an option to cancel the cover rather earlier and drive very restrictive, having the best control over the vehicle possible, and if there is an opportunity take the premiums not paid for cover and put it in a savings account, so you do have something if a risk can't be avoided.

It is actually a good way to go and save those premiums and drive cautiously. That can give a carefully driving motorist some extra retirement funds, but affords strict adherence to pay into the savings account, at least unless a substantial amount will be reached, that will cover a conventional accident damage claim.

4.2. Alledged you haven't disclosed relevant information or not been completely honest, when concluding the contract or reporting a claim.

As you know your relation to your insurance is contractual. That means both parties need to abide to the rules, laid out in the policy and its attachments etc.

A central obligation can be, to update your insurer about certain factors, you may find negligible and therefore, you didn't do so, as it is your duty.

Those are commonly: Regular driver, risk area, and coverage of the car during day or night. Those issues are frequently the matter of investigation and if not properly updated may cause some trouble, if car accident damage need to be compensated.

Violating your duties, it is an easy point for your insurer to scrutinise and find arguments, if they want to give you a hard time, or even entitle them eventually to reject your claim, rightfully but not fair, at least from your point of view.

A number of those declines can be challenged in a dispute resolution process with the insurer and further reviewed in and Ombudsman approach, if the matter in question is based on comprehensive cover.

However experience tell, that just repeating the arguments of the past, is most commonly not good enough to get a decline exchanged against a pay-out.

A complainant should really know what is fact and what is fiction, as they deal with people don't do anything else as dealing with MVA - Motor Vehicle Accident claims, on a daily bases. Getting some experienced support in time, can be of huge benefit and can alter the outcome of a dispute review, getting an advanced financial recuperation. You can check out RAMLA, to help with or pursuit your matter.

It is further very important, that you can proof you updated any data that may be required. RAMLA dealt with a number of cases where the client insists to have updated the circumstances, but the insurance denied to ever receiving the relevant information.

The reason for your insurer, to have actual knowledge of any such changes required to update, is to enable them to calculate the risk on the true and actual circumstances.

I.e let's say, your car is now relocated to another city or province, where the insurance determine other rates apply, they will probably succeed against any complaint, even before the ombudsman, if indeed the change of the risk profile would have created a higher risk and therefore entitle them for higher premiums.

4.3. Missed updating your policy details as to define the regular driver or relocation, change of the risk area the car is regularly driven.

Motor insurance companies commonly requires specified changes in the personal environment to be updated to the policy, as they claim those factors may have influence on the risk and premiums accordingly. The argument is low risk, low premium, and high risk higher premiums.

What however is observed in regard of the above, that those obligations, sometimes rather neglected by the insured, being used to decline a claim, in which suspicious circumstances may have been detected, if no better arguments for repudiation can be found.

As an example: most insured are obliged to update the policy if they have defaulted on debt, even given the premiums always been paid in time. The default does not have any effect on the policy, as long the premiums are paid in time, but can and had been utilised to decline a claim, once it could be established that a financial default has been detected.

Why is "regular driver" and "nominated driver" important for car the motor car insurance?

One part in the terms and conditions of motor vehicle insurance policies, commonly stipulates who is the "regular driver" or a "nominated driver", meaning drivers that are legitimate to utilise the insured motor car and been covered for risks being the overwhelmingly most common driver.

Not jeopardy problems or even give the insurer the chance to reject a claim on this reason, in a case to claim for motor accident damage compensation, it is important that the insured correctly identify and disclose the regular driver. In cases where more than one person will drive a motor vehicle regularly, they should all be registered with the policy.

It won't help an insured to pay the premiums, if there is no certainty that in case of a claim, it will not be rejected on technical terms, even if a full and truthful declaration of the regular user may increase the monthly instalment.

On the other hand, a car owner will be entitled to allow others, not frequently driving the car, to drive it, here and there for whatever purpose, as long they are proper licenced. Those drivers are regularly covered under the policy, if unexpectedly an accident occurs in such time the vehicle is given to a third person.

However, if a vehicle is given to another, not registered as the regular driver, for permanent or overwhelming use, this will be against the policy and the idea of insurance cover, as to calculate risk to the profile of the driver, - age, experience, personal effects etc. -, and the risk emanating from the type of a vehicle, such as value. It is most evident that i.e. a Ferrari will be more expensive as a VW, so premiums will be higher. Sports cars or tuned editions of types may indicate a more risky driving attitude as a good old family van.

Taking on the policy, everybody will be questioned about the regular driver and notified about the importance to update, to have a valid cover.

If i.e. an insured do have several or more than one car insured for him/her as the regular driver and in fact given the new one to the child, going to University or to work with the car regularly, on a permanent basis, it will be a clear violation of the terms and cover denied. That in turn won't be worth paying premiums at all.

In other words, registering the regular driver with an insured car into the name of someone in fact don't drive the car, isn't worth the premium and should not be considered. Either drive without insurance cover or declare the true driver with the policy, even if that increased the premium.

But, and this is the case in many insurance disputes, the Insurer alleges a driver caused an accident, hasn't been unveiled and registered with the policy to be the regular driver. This can lead to a claim decline and the allegation of material misrepresentation, or fraudulent behaviour, even in case a car been given or borrowed to another, for whatever short term purposes, for them allow utilising the car for some time, and thereafter it gets back to its own (the owners and/or registered drivers) use.

The material difference here is, the intention of a short term use of the insured car by another, or the intention giving use to someone permanently, but not registered as regular driver.

The details will be depended on the policies wording, what is a regular driver and when to report such a change. Some South African Motor Insurers explicitly say a regular driver must be definite in monthly intervals and immediately, but even on these very restricted terms, there are many arguments to rebut a declined claim, certainly depending on particular circumstances.

A "regular driver" may be seen as "the person who uses the motor vehicle most frequently and more than any other". Where a motor insurance policy is issued on a "regular driver basis", other persons may drive the motor vehicle in addition to the regular driver, but they must at least be in possession of a valid driver's license and they should only be the minor car driver.

What is the difference between a regular driver and the nominated driver?

A "nominated driver", is a person who is actually nominated by the insured and positively documented as a nominated driver on record of the car insurance company. Any person who is not nominated and recorded, as a nominated driver, may give you problems in a damage claim to be accepted and covered.

You must be honest to your insurance company and hopefully know your terms and conditions, as well as possible loopholes or shortage of cover, you may have accepted in the policy to save premiums.

What problems are you facing, if your vehicle is incorrectly insured and/or inappropriate information given to your motor insurance company?

If a vehicle is incorrectly insured or incorrect information is furnished about either a regular driver or a nominated driver or the risk area the car is driven and kept predominately, it can result in a policy being declared null and void from beginning, or the insurer may try to avoid liability to compensate for any loss or damage.

Such simple reasons, as failure to submit data as to the drivers status, keeping your current address updated, or not informing the insurer about the location/area the insured car is used in daily life, if it has changed, when you operate the car on a different terrain as from your home for a longer period, you need to inform your insurer correctly and in time. This certainly does not mean a holiday trip etc., but once the motor car will be predominately be used elsewhere as lodged with the insurer, can give problems if not updated with the policy.

The insurance company's use such differences in order to classify and categorise the risk they are exposed to, resulting out of your individual circumstances. This has a link to your premiums to be paid for the cover you hopefully enjoy, in the daily use of your insured auto.

4.4 Driving a not roadworthy vehicle

What will be the case if you are driving an un-roadworthy vehicle when a car accident happened?

Generally spoken a motor car taking part in public traffic should be roadworthy to all times. There are a lot of factors that may give the not roadworthy status to a motor vehicle. Lot of singular factors are given in other sections of this page as - bad tyres -.

A car owner and the driver are subject to control roadworthiness on a permanent basis. The car owner is responsible to keep the car in good technical condition, so everything required is functioning properly.

Once an accident occur and probably caused, i.e by a burst tyre, and a claim declined based on an argument of sudden and unforeseen technical emergency, isn't acceptable at all. A tyre does not burst, if it is in good shape and no other obstacles as i.e. an unforeseen pothole damages a tyre. Claiming sudden technical emergency is nowadays nearly impossible, as technical maintenance of high standard is available and everyone taking part in public traffic, a car owner is obliged to maintain the vehicle to those standards.

Un-roadworthiness may start with an expired licence, simply not paid up. Lights not functioning properly can cause such status. Failing brakes, unrepaired other damages, or the car is not completely assembled as well as many other simple reasons, such as not having a roadworthy certificate, next to a missed out continuous maintenance, can cause to be categorised the car as not a roadworthy vehicle.

But as always, a simplified argumentation must not automatically be good enough to really create liability throughout un-roadworthiness, as it is always the detail and the circumstances of any individual case that will decide reasonability and foreseeability and resulting negligence, throughout lack of reasonable care.

For example, if the engine will not function probably, it will not automatically give the vehicle a un-/not roadworthy status.

When it comes to analyse, what will be the effect of a not roadworthy vehicle in terms of motor insurance cover, the type of failure leading to the classification not being roadworthy, must have a direct effect to the cause of the accident.

In other words, if the car would have been roadworthy, meaning i.e. the brakes had functioned well, the impact could have been avoided or the damage at least minimised, will have an effect on the insurance cover. On the other hand, front lights not working, but the accident happen in daylight wouldn't.

But just minor technical defects or bad maintenance cannot as easily justify a claim decline and it will be worth-while to look into details, before accepting a claim decline on such reasons.

If the other party, generally liable for the cause of the accident, or its insurance company, can proof successfully, that your car has not been roadworthy, it can shift the liability from the one party deemed liable to the one, who drove a not roadworthy motor car, but did indeed not been the cause of the traffic accident, by driving negligent or violating the rules of the road, other as roadworthiness.

4.5. You are accused of driving under alcohol or drugs

Driving under the influence of alcohol or drugs is dangerous and forbidden and will lead to loss of any insurance cover.

Intoxication at all, will come to the effect that an existing insurance cover will not pay for such particular incident when drunk driving is alleged. Being on the road intoxicated will endanger the safety of all motorists - don't drink and drive.

But there are cases where pure accusations of being intoxicated during driving in public traffic, lead to a claim denial.

Accusing someone of having driven in an alcoholic state, is not sufficient to decline a claim and the insurance company need to have sufficient backing, such as positive breath test a valid blood test, proving the intoxication being over the tolerated level, to decline a claim.

If you indeed weren't drunk or within the limit the law allows, no decline of a damage claim may stand a review.

Having said that, however there are many claim insurance declines bases just on witness allegations, such of paramedics having smelled alcohol or observed strange human behaviour. Other declines have only been based on "witness" statements, that they smell alcohol or just allege intoxication, based on somebody's layman analyses.

No one can materially detect Intoxication over the level of tolerance, other than bold tests. No layman, not even qualified medical stuff, can detect and proof intoxication effectively.

We have had cases, where the Investigator based his claim decline on the witness, a waitress in a pub saying, the accused have had about three beers. There is no evidence that this consumption will lead to have exceeded the allowed limit when driving, as the time factor of detoxication and the body mass and other factors cannot be determined by assuring to have served three beers to the alleged drunk driver.

Anyhow, such testimony may serve as an indication and call for a full probe, a test needs to be performed.

In some cases, the other party just made a statement, maybe even under oath, the other party have been drunk. But again, that will not be sufficient proof, but an easy way of shifting liability and/or causing trouble as many take the allegation as valid to conclude, the drunk driver will most certainly be the liable. A proof of drunk driving can only be a clinical blood test, or at a weaker state breaths test, with a functioning device and proper handling.

Should a blood test will be missing, this certainly does mean, your insurance company cannot decline a claim on grounds of drunk driving, if there is no hard evidence.

Back to Selection

4.6. Texting or telephoning while driving

Texting and Telephoning during motor vehicle driving in public traffic in South Africa, is an offence and should indeed be avoided

Using your mobile device while driving a car, either by telephoning, texting or browsing purpose is not a good idea. The police will fine you if they catch you.

But more badly, if it can be proven that you did a phone call or concentrate on your mobile device or navigator inappropriate while driving a vehicle on public roads and thereby contribute or even cause a traffic accident, by not watch out properly, observe the traffic around you etc., you find yourself accused to be liable or at least partly liable for the traffic collision and damages.

A motorist must be aware, that Insurance companies check the mobile beacon report regularly, either to establish the phone been with the driver and if used at the location and time of the accident, it is a profound proof for negligence. If the Insured refused to allow the Insurer to access the beacon report (cell phone record of usage), the claim will be cancelled on reasons of non-cooperation, as set out in the policy.

Be aware that South African motor insurance companies will attempt and scrutinise your service provider to supply your call records that reveals the time of usage, which can serve as a certain proof. But even there can be exemptions that weaken or dismiss such proof.

Your insurance cover may be withdrawn and you pay for all motor damage with you own money, if proof of your texting, telephoning etc. will be valid.

Texting and telephoning during driving reduces reaction times of drivers and are prohibited in road traffic in South Africa. It can be proven, if your insurance company check with you telephone service provider, which is common procedure these days.

According to the National Roads and Motorists Association, text messaging drivers spent up to 400 % more time with their eyes on the phone instead of on the road.

The reaction times of a texting driver worsened by 35 % and are much worse than driving under the influence of alcohol at the legal limit, as those were only 12 % slower in reaction time, or those who had taken drugs, who were about 21 % cent slower.

A texting of telephoning driver seriously take the risk to roam the lane, not concentrating to traffic.

If there is evidence that the driver caused the accident while making calls or texting behind the steering wheel, it is understandable that any motor car insurance claim originating from such car accidents, would be justifiably rejected by the insurance company. Only proper fixed telephone devices connected to a microphone and speakers are allowed to use behind the steering, but still poses risk of not been concentrated.

4.7. Breach of the rules of the road

Can your motor car insurance claim be rejected, just because you are called a "bad driver"?

No, just being a "bad driver" cannot be utilised by your motor insurance company to reject your claim for car accident damages. If a motorist only violates some minor traffic law, it will be an offence of course, and depending on intensity, it can be prosecuted, but not a reason for a decline of insurance cover, in general.

But the quality of your driving can affect your car insurance policy and your premiums to be paid or worse can lead to a cancelation of your car insurance cover at all.

Concluding motor car insurance, with most of the South African insurance companies will be easy, as they compete heavily for all motorists to cover them. To this moment of time, when you conclude your police (insurance contract), all the car insurers knows about you, is your driving experience and previous accident record and some insight with regards to traffic violations.

The vary factors will have influence on the premium, or even acceptance of your insurance application.

All information required, must be disclosed honestly by the vehicle owner/applicant, in his application for motor insurance cover. That is all about the insurance company knows about your individual driving and personal circumstances, allowing to calculate your premium or select the appropriate tariff. Failing to disclose all relevant factors properly, will not grant you insurance cover, even if you got confirmation and paid the premiums up.

Looking on to the question, if bad driving can be a cause for your insurer to reject your claim, we citing a decision from the Ombudsman for short term insurance in South Africa, but there is no legal definition of what is "a bad driver".

The mater referred to the Ombudsman was, whether careless driving, and therefore the failure to prevent the vehicle accident on reason of bad driving, would justify the decision to reject the car insurance compensation claim.

When a motor insurance company tries to reject a claim on ground of bad driving, the onus to prove lack of due care is on them.

As an example what the ruling of the Ombudsman was in such matter we refer:

A motor car driver involved and insured in a road traffic collision, obtained her driver's licence on 1st August and some months later, she was on her way to work as the crash happened.

One reason that led to the vehicle crash, had been that she drove too closely behind another vehicle, which she say, "stopped unexpectedly and abruptly". In an attempt to avoid a collision with the back of the vehicle before her, she decided to turn in an intersection, where she collided with a vehicle that was travelling in the opposite direction and on its way to turning right.

Whilst turning into the intersection, the traffic light had already changed to red against her. The claim was rejected on the argument that the Insured failed to exercise due care and the action taken was grossly negligent.

But still this particular decision can be challenged, as there have been proven evasive measurers taken by the driver. Despite such evasive measures, the inexperienced driver couldn't foresee the sudden breaking of the motor car before her, and not avoid the collision with another in her action to avoid the collision.

This cannot be seen as grossly negligent as her main fault was just having not kept sufficient following distance. Such decision, declining the claim on reasons of gross negligence, should be challenged in a court of law.

4.8. Not taking reasonable precaution while driving

Can your motor car insurance claim be rejected, if you don't take reasonable care while driving?

The insurance must proof your "conduct was gross negligent" to be able to sustain a decline of your claim.

The Ombudsman for short term insurance and motor car insurance in response

Source: Ombudsman's No. 02/2006

The Ombudsman cited the well-known case of Santam Limited versus CC Designing CC 1994 SA 199, and in the unreported judgement of Stax Masango and Lloyd's of London, where it is stated that the onus is on the Insurer to prove that the insured's "conduct was such gross negligent, that the conclusion can be proven that the driver recognised the dangers to which his exercise can lead, which he himself knew were inadequate to prevent any collision, or about he simply did not care, in the knowledge that he was insured".

The insurance company settled the claim under that pressure.

Your car insurance claim cannot just be fairly rejected because you are called a bad driver. But being a "bad driver" can have a significant effect on your car insurance premium, if you are involved in numerous vehicle accidents or it may even end up in a loss of your insurance cover.

Your car insurance company wants to know who is driving your car, not to have a problem in a case of motor accident.

According to the terms and conditions you agreed upon, when you conclude your motor insurance contract, you must be well aware all your exclusions and know your obligation that you should meet, best to all times.

Being aware of the content and car insurance policy and complying as good as possible, you do best to avoid hassles. Take notice that your car may not be insured without full disclosure of what the insurance company wants and is entitled to know, i.e. who the regular drivers of your car might be or who is nominate as specific drivers on that motor vehicle.

The Ombudsman for Short-Term Insurance in South Africa has warned consumers, to ensure that they fully understand and being happy with the basis of the insurance contract, upon which motor vehicle insurance had been concluded and expose and categorise the persons driving the vehicle to the insurance, to have them covered whilst driving the motor vehicle belonging to the insured.

4.9. Drunk driving, driving without licence, severe overload

Drunk driving or driving under the influence of any other drugs that have intoxicating effects, is an offence and will lead to lose any insurance cover.

You lose even your 3rd party cover and must pay for the damages to the other parties, out of your pocket.

However these day's we experience more and more problems, as a motorist involved in a car collision just to night time, will most probably be scrutinise for drunk driving. Investigation being launched, persons interviewed, meeting to question the party arranged, in order finding proof of drunk driving, or at least speculative allege driving under the influence.

But the only proof for drunk driving is a breath test, but more sustainable a clinical analysed blood test of alcohol concentration.

Confronted with an insurance investigation, should trigger high alert and persons to be interviewed should know what they say or do. There is an o/oo limit in South African traffic legislation and as soon the blood alcohol exceeded limitation, its bad and hardly to challenge.

However, one can have a drink and not exceed the limit. If there is no blood or breath test at least, it is hard for anyone alleging drunk driving, to proof it with evidence that stand a challenge in a court of law.

But once a motorist in such a situation acknowledge having a beer or two, it may be good enough, encourage a motor insurer declining a claim, even without proper evidence.

The same detrimental effect you will face, if you are not having a valid driver's license and any claim can be revoked as gross negligent act.

Severe overload is very dangerous and will lead to the fact that your vehicle is not roadworthy to the time you are driving with such overload.

Transporting more persons with the vehicle as the vehicle licence allows, and getting caught in an accident and further worse, persons sustain bodily injuries or even death; one will be facing criminal procedures on top of risking the insurance cover.

4.10. Decline of a motor insurance claim based on not properly declared regular driver or change of the area of predominant use.

In South Africa motor insurance policies and cost for cover are calculated individually to personal risk factors, under the argument this will guarantee the best possible premium for a specified motor accident cover.

This means individual risk profiles are scrutinised and accordingly the premium calculated. Matters of secure parking, age and times holding a valid driving licence, etc. are factors that determine the cover and the premium.

In such regard, the person driving the motorcar regularly and is the registered or nominated driver for the vehicle, it is important for the insurer being able calculate a risk as to the above said.

The insurance risk of the nominated driver in the policy and another in reality driving the motor car, may well be seen different.

If i.e. parents give or buy a car for kids, but choose register themselves as regular driver, as they are lower risks to age and experience and insurance track record as the child, a newcomer on the road, take a high risk of claim decline, despite paying premiums, if the Insurer find out about the child being the regular driver.

Once the motor accident occurs, the actual driver will be identified. If different to the regular driver registered with the contract, investigations may well be initiated. Questions be asked and interviews arranged to find out, who indeed is practically the regular driver and only satisfied that the driver causing the accident has been just allowed to drive one or the other time this particular vehicle, the cover may be valid, may be with some extended insurance excess.

Report to your Insurer a change in the permanent or at least overwhelmingly area of operation, if it changes.

It will be similar that traffic accidents will be scrutinised more in detail, in cases the vehicle accident will be far from home, the place or area the insured motor car is supposed to be predominant located.

It will indeed be a difference for an insurance to calculate premiums and risks, if a motor car will be driven in a quiet town, like Caledon in the Western Cape, or in major cities as Bloemfontein or even Johannesburg. The traffic density will be significantly different and the extended risk being involved in a traffic accident is not a question.

Any extended or higher grade of risk, covered by a motor insurance policy, where premiums are calculated on risks assessment, will include the need and the right to look into the risk factors and adjust premiums as applicable or due to changes in risk factors, made by the insured.

This does not mean, an insured car isn't allowed to be taken for a trip, even to such extended risk areas, but changing the permanent or at least overwhelmingly area of operation, needs to be reported to the insurer, allowing them to exercise the right to adjust risks and accordingly premiums, as soon as possible and better before an accident occur.

(5) Your obligations in relations with your motor insurance policy

5.1. Your premiums must be paid up.

Unfortunately, without the premium paid up, you do not have insurance cover at all.

Should you have made an arrangement with your Insurer about premiums outstanding and have been assured to further do have cover, you better get that in writing or save a copy of the correspondence, stating so.

Only then one get the claim entertained.

5.2. You must or better should report a claim even if you don't intend to utilise the cover

We like to give you an illustration what kind of disadvantages you may face, if you were in accident with another car and did not report the incident to your motor insurance company.

Furthermore motor car accidents on South African roads need to be reported to the South African Police within 24 hours after an accident. There are motor insurance companies, which repudiate a claim, if the matter hasn't reported to the police.

The only exemption the accident doesn't need to be reported to SAPS will be, if no 3rd party has been involved and no bodily harm occurred.

Sometimes the damage resulting out of a traffic accident appear to be only of minor value, maybe just a small dent in your bumper or a little scratch on the other cars door.

Both of you do not feel any pain presently and no other remarkable circumstances are noted, so you and the other driver agree to pay each other's damages out of your own pocket and you don't file a claim against each other or any insurance company and not report the car accident to your insurances in order to keep your risk profile with them low.

It might well be that sometimes later, the other driver gives you a call, saying that he indeed has thousands of rand in damage and he's having neck and back pain. On the other hand it may even be the case you have more serious car damage or feeling pains for which you blame the motor car accident as the cause.

Both such instances can trigger a claim, if the other party may have long forgotten about the matter. Prescription time, the period in which a claim must be made before a party is barred to do so, is three years from occurrence. Only after three years one can be certain, that there is no more risk in an old accident matter. That is a long time.

Just because you didn't file a claim in time or at least reported the incident, your insurance company may refuse to pay any damages now; leaving you stranded despite you paid your premiums.

You may feel very unhappy about the situation, if the other car driver files a claim for this traffic accident with his or her insurance company, while insured comprehensive later on, without you being aware the matter? If the other parties' insurer pays his or her claim, most commonly the recovery department of the other insurance company then come to you, to recover what it paid out to its client, blaming you being the liable party.